USDT Ban in Iran: What Happened and How It Changed Crypto Use

When the Iranian government moved to ban USDT, a stablecoin pegged to the US dollar and widely used as a digital alternative to cash. Also known as Tether, it became one of the most trusted ways for Iranians to protect their savings from hyperinflation and currency collapse. The ban wasn’t about stopping crypto—it was about stopping people from moving money out of the country. But like most top-down controls in unstable economies, it didn’t work the way officials planned.

Iran’s central bank tried to enforce the ban by pressuring banks and payment processors to cut off access to USDT trading. At the same time, the Iranian rial kept losing value—sometimes over 50% in a single year. So people didn’t stop using USDT. They just got smarter. Peer-to-peer (P2P) platforms exploded. Local traders swapped rials for USDT in cash deals, in cafes, even in parking lots. Crypto wallets became the new bank accounts. And because USDT is built on blockchains like Ethereum and Tron, it’s nearly impossible to fully block without shutting down the entire internet—which no government wants to do.

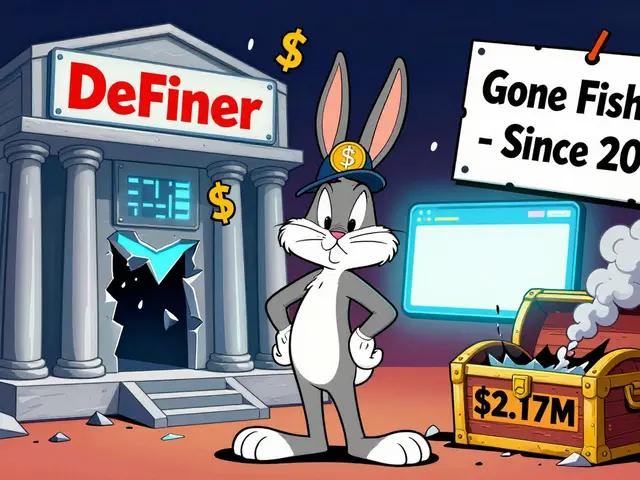

The ban also forced Iran to look at other stablecoins and workarounds. Some turned to USDC, a dollar-backed stablecoin regulated by U.S. financial authorities, even though it’s technically harder to access under sanctions. Others used TON, the blockchain behind Telegram’s crypto ecosystem, because it allowed anonymous, fast transfers with low fees. Meanwhile, local exchanges like BIJIEEX (which users later realized was likely a misspelled or fake platform) popped up, offering risky alternatives with poor security—just like the defunct Oasis Swap or Shido DEX that vanished after scams surfaced.

This isn’t just about Iran. It’s a pattern seen in Venezuela, Nigeria, Argentina, and Namibia—places where banking systems fail, and people turn to crypto not for speculation, but survival. The USDT ban in Iran didn’t kill stablecoin use. It revealed how deeply embedded digital money has become in daily life when traditional systems break down. People aren’t chasing get-rich-quick schemes. They’re trying to buy food, pay rent, or send money home to family. And if the government won’t let them use dollars, they’ll use a blockchain version instead.

What you’ll find in the posts below are real stories from people navigating crypto under pressure. From exchanges that disappeared overnight to airdrops that turned out to be scams, these articles show how users in restricted economies adapt, survive, and sometimes get burned. There’s no magic fix. But there’s a lot to learn from what actually works—and what gets people robbed.

Categories