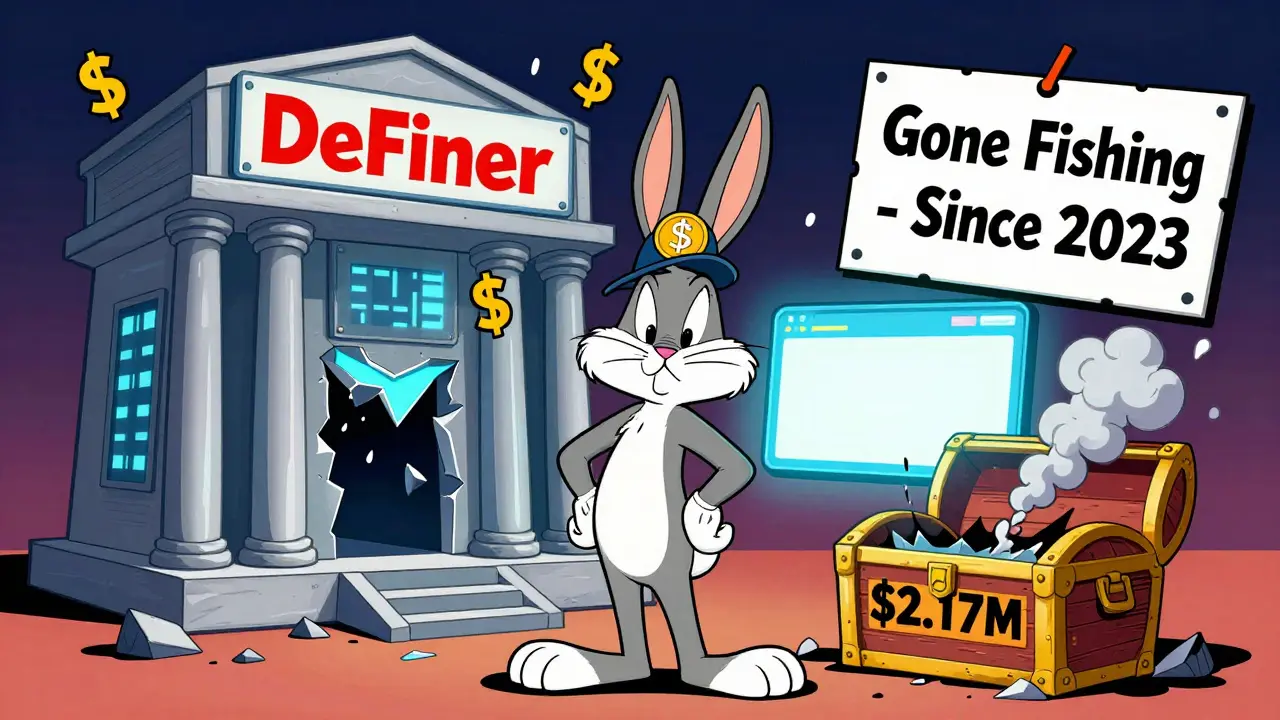

DeFiner (FIN) was supposed to be a simple way to earn interest on your crypto. Launched in September 2020, it promised users could lend their digital assets and get paid back with interest-all without a bank. But today, DeFiner isn’t a platform. It’s a ghost. The website redirects to a blank page. The Twitter account hasn’t posted since mid-2023. The code on GitHub hasn’t been updated in over three years. And the token? It’s worth less than a penny-$0.000028 as of late 2025-and trades on just one exchange, with almost no volume.

What DeFiner was supposed to do

DeFiner was built as an ERC20 token on Ethereum. Its goal was to create a decentralized finance (DeFi) platform where users could save, lend, and borrow crypto without intermediaries. Think of it like a digital credit union, but powered by smart contracts. If you had Ethereum, Bitcoin (wrapped), or other supported tokens, you could lock them up and earn interest. Others could borrow against their holdings, paying interest in return. The FIN token was meant to power the system-used for fees, governance, and rewards.

At launch, it raised $2.17 million across six funding rounds, including an initial DEX offering (IDO). That kind of backing usually signals serious intent. Early investors were promised a platform that combined savings, lending, and payments in one place-a rare feature back in 2020. But the promise never materialized.

How the token crashed

DeFiner’s price peaked at $0.0524 in early 2021. That’s over 1,800 times what it’s worth today. Since then, it’s lost 99.95% of its value. Why? Because the project stopped working.

By mid-2023, the team vanished. No updates. No blog posts. No community calls. The official website, definer.org, now shows a parked domain-just a blank page with ads. The Twitter handle @DeFinerOrg last tweeted in June 2023. GitHub, where developers normally push code, shows zero commits since Q4 2021. No new features. No bug fixes. No upgrades.

Today, the market cap sits at $4,146. That’s less than the cost of a used laptop. The circulating supply is 148 million FIN tokens out of a max of 168 million. With a 24-hour trading volume of just $53,000-all on AscendEX (formerly BitMax)-there’s almost no liquidity. You can’t buy it easily. You can’t sell it without dragging the price down. And no major exchange lists it.

How it compares to other DeFi projects

DeFi isn’t dead. Aave and Compound are worth billions. They have active teams, regular updates, and deep liquidity. Aave alone has a market cap of $1.78 billion. DeFiner’s entire value is 0.00000011% of that. It doesn’t just lag behind-it’s not even in the same league.

Most successful DeFi tokens have multiple exchanges, high trading volume, and active development. DeFiner has none of that. Its trading volume is less than 0.005% of Uniswap’s daily volume. It’s ranked #12,610 by market cap on some platforms. On others, it’s #2,843-showing how unreliable rankings are when the project is essentially gone.

Even among forgotten crypto projects, DeFiner stands out. Most failed tokens still have a community or a GitHub repo. DeFiner has neither. It’s not just inactive-it’s abandoned.

Why no one talks about it anymore

There’s no buzz. No Reddit threads. No YouTube explainers. No news coverage. A quick search on Reddit shows only 12 mentions of DeFiner in the past year. One user summed it up: “FIN token appears completely abandoned-website redirects to a parking page, Twitter hasn’t posted since 2023.”

Review sites like Trustpilot have zero reviews. No one’s left feedback because no one’s using it. Even crypto education platforms like Bitget still host old articles about DeFiner’s original features-but they don’t update them. That’s not support. That’s archival.

Analysts at CoinDesk and Delphi Digital classify DeFiner as a dead project. Messari’s Q4 2025 report says projects with market caps under $100,000 have a 98.7% failure rate within 18 months. DeFiner’s is under $5,000. It’s not just failing-it’s already buried.

What happened to the money raised?

The team raised $2.17 million. That’s real money. It should have been enough to build, market, and sustain a DeFi platform for years. So where did it go? No one knows. There’s no public audit. No transparent treasury. No explanation.

The fully diluted valuation (FDV)-what the token would be worth if all 168 million were in circulation-is only $4,700. That means the team burned through millions to create a token worth less than $5,000 today. Early investors lost nearly everything. Those who bought at the peak? Their holdings are worth 0.05% of what they paid.

This isn’t market volatility. This is value destruction.

Is DeFiner still usable?

No. Not really.

You can still buy FIN tokens on AscendEX if you want to. But there’s no platform to use them on. No lending interface. No borrowing portal. No staking dashboard. The smart contracts might still exist on Ethereum-but they’re not maintained. No one’s paying interest. No one’s borrowing. The system is frozen.

If you hold FIN today, you’re holding a digital receipt for a service that no longer exists. There’s no roadmap. No team to contact. No way to recover your investment. The only thing left is the token balance in your wallet-and the cold reality that it’s worthless.

What you should do if you own FIN

If you bought DeFiner during its launch or early days, you’re likely underwater. The smart move now is to cut your losses. Selling might not recover much-but holding it won’t help. There’s no recovery scenario. No whitepaper update. No new team. No revival.

Don’t fall for the “it’ll bounce back” myth. That’s how people lose more money. DeFiner’s decline follows a textbook pattern: raised funds, launched token, vanished. It’s happened dozens of times in crypto. Most projects like this don’t come back.

If you’re still holding FIN, consider it a lesson-not an asset. The crypto space is full of shiny promises. But without transparency, activity, and accountability, even the most promising ideas die fast.

Final verdict: DeFiner is dead

DeFiner (FIN) is not a crypto project you should invest in. It’s not even a project you should track. It’s a graveyard entry in the history of DeFi.

It had potential. It had funding. It had timing. But it lacked execution. And in crypto, execution is everything. Without a team, without updates, without users, the token has no value. Not even symbolic.

If you’re looking for a DeFi savings platform, look at Aave, Compound, or MakerDAO. They’re active, audited, and growing. DeFiner? It’s a cautionary tale. A reminder that in crypto, if no one’s building, no one’s buying-and nothing lasts.