Crypto Trading: What It Really Means and How to Avoid Common Traps

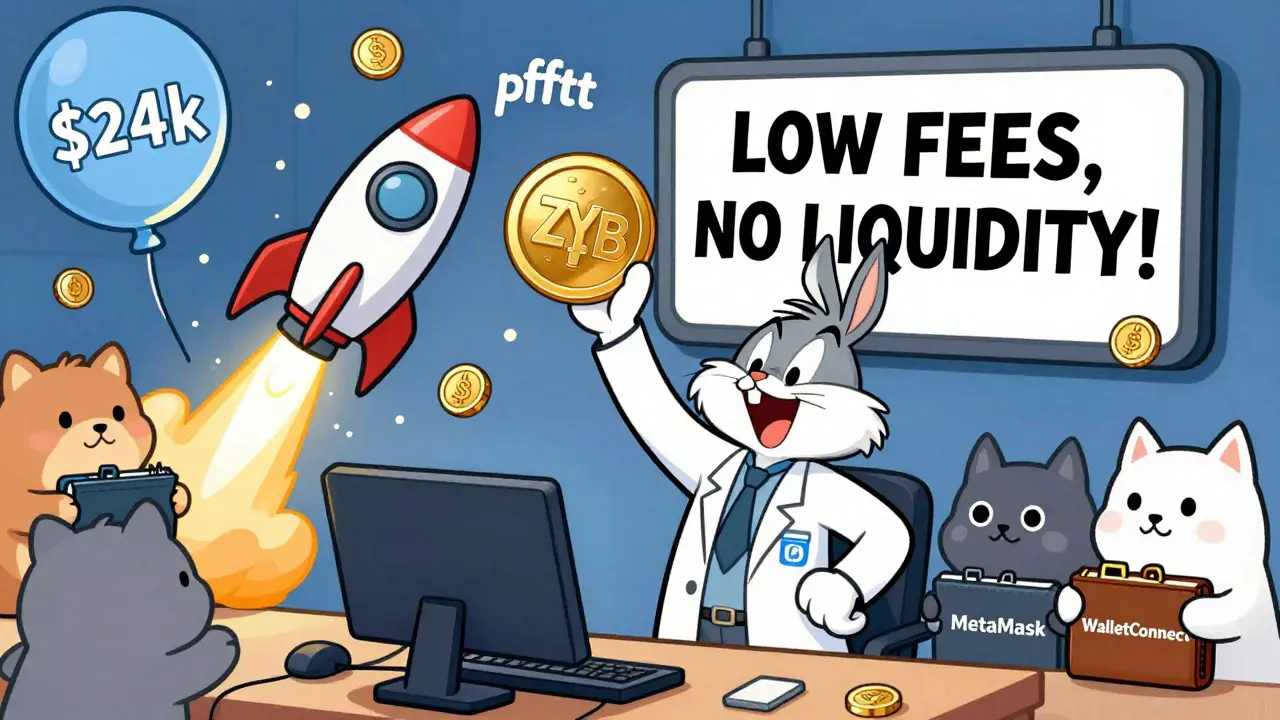

When you hear crypto trading, the act of buying and selling digital currencies like Bitcoin or Ethereum to profit from price changes. Also known as digital asset trading, it’s not just about charts and candlesticks—it’s about understanding who’s behind the coins, where they’re traded, and whether the platform you’re using is even legal. Most people think crypto trading means jumping into a coin because it’s trending, but the real game is avoiding traps. Look at the posts below: BIJIEEX, Neblidex, and Oasis Swap all looked like real exchanges until users couldn’t withdraw their money. These aren’t edge cases—they’re the norm for unregulated platforms.

Behind every fake airdrop like BAKECOIN or ETHPAD’s GRAND is a simple trick: get you to send crypto first. Real airdrops don’t ask for funds. They give tokens for free if you meet basic criteria, like holding a specific coin or signing up with a verified email. The same goes for crypto scams, fraudulent projects designed to steal money under the guise of investment opportunities. They use hype, fake team photos, and borrowed logos to look legitimate. Meanwhile, places like Biteeu and AUSTRAC-registered exchanges in Australia operate under clear rules—they’re audited, licensed, and accountable. That’s not luck. It’s structure.

And it’s not just about exchanges. Countries like Iran and Namibia have banned banks from touching crypto, yet people still trade using peer-to-peer networks and stablecoins like DAI. In India, users bypass taxes and restrictions with UPI payments, turning crypto into daily cash flow. These aren’t theoretical debates—they’re real behaviors shaping how regulated crypto platforms, crypto exchanges that follow government rules and offer user protections survive and grow. You can’t trade safely if you don’t know where the lines are drawn.

What you’ll find below isn’t a list of coins to buy. It’s a map of where the risks hide: fake exchanges, phantom airdrops, silent projects, and legal gray zones. Each post cuts through the noise with hard facts—no fluff, no hype. Whether you’re trying to avoid a scam, understand why a platform vanished, or figure out if your country even lets you trade, you’ll find the answers here. No guessing. No promises. Just what’s real.

Categories