19 May 2025 |

Blockchain Technology

|

by

James Stanitz

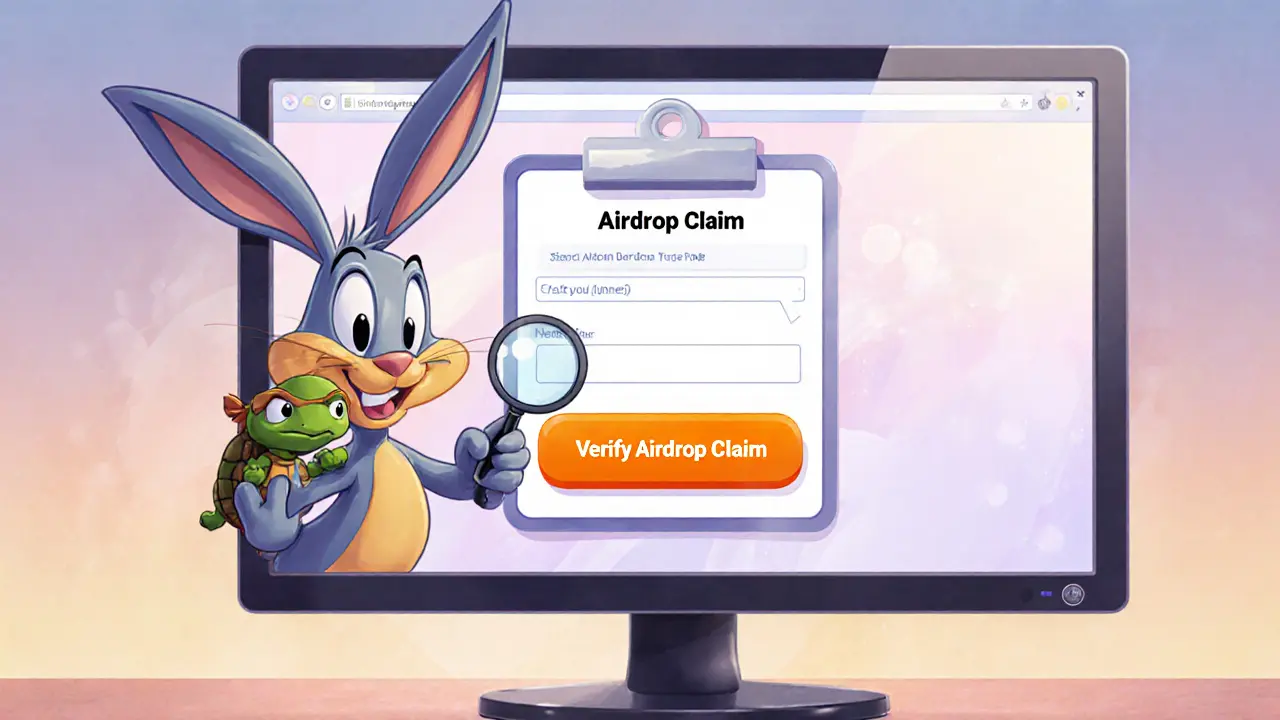

MOT Token Verification Checker

Important: This tool helps you verify whether a MOT airdrop claim is legitimate. Scammers often mimic official announcements. Always verify on official channels.

Categories