Many people search for "Unifi Protocol DAO crypto exchange" thinking it’s a platform like Binance or Coinbase where you can buy and sell crypto with a simple interface. That’s not true. Unifi Protocol DAO isn’t a crypto exchange at all. It’s a decentralized finance (DeFi) ecosystem built on smart contracts that lets users trade, stake, and move assets across multiple blockchains - without giving up control of their funds.

What Unifi Protocol DAO Actually Is

Unifi Protocol DAO is a governance model powered by the UNFI token. It’s not a company, not a website you log into, and definitely not a centralized exchange. Instead, it’s a collection of decentralized applications (DApps) running on Ethereum, Binance Smart Chain, and other networks. Think of it like a toolkit for DeFi developers and users who want to move assets between chains without relying on third parties. The ecosystem has three core components:- uTrade: A decentralized exchange (DEX) that lets you swap tokens across chains - like trading ETH for BNB without needing a bridge or intermediary.

- uStake: Lets you stake UNFI or other supported tokens to earn rewards across multiple blockchains.

- uBridge: Connects different blockchains so tokens can move between them securely and cheaply.

Why People Get Confused

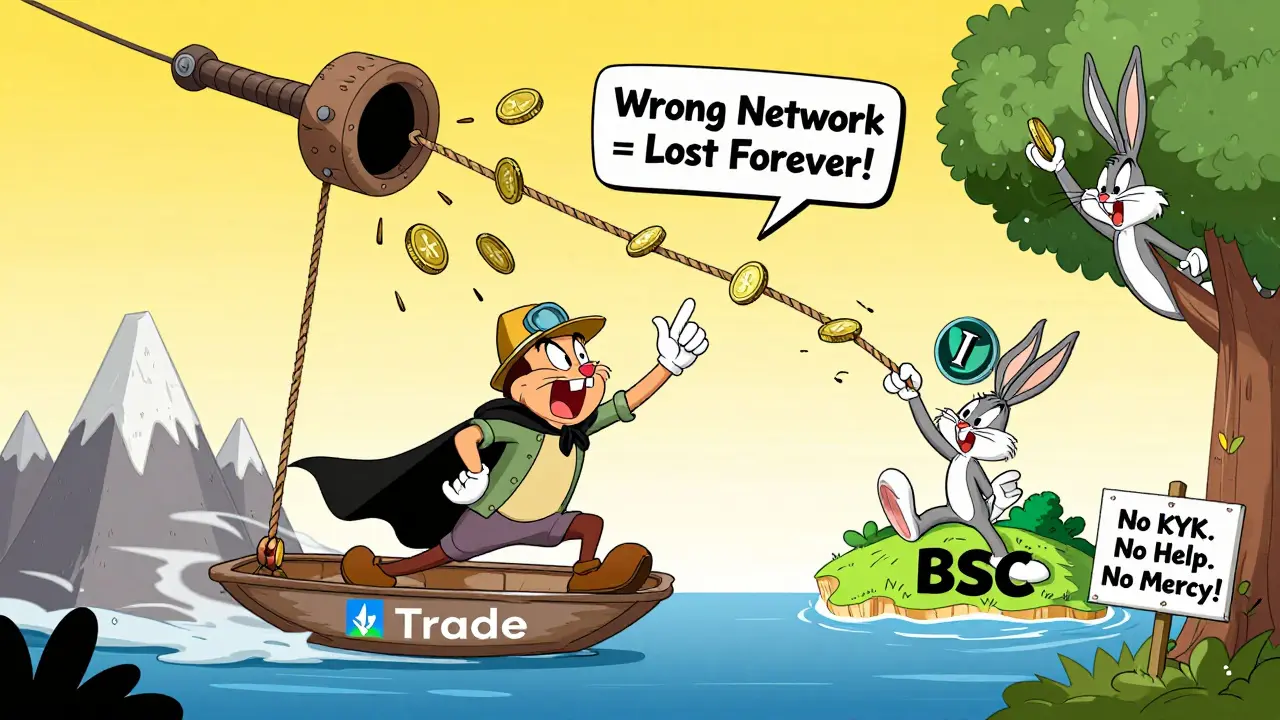

The confusion comes from how uTrade works. It looks and feels like a DEX - you connect your wallet, pick tokens, and swap. But unlike centralized exchanges, there’s no customer support, no KYC, and no account recovery. If you send tokens to the wrong network, you lose them. That’s not a bug - it’s how DeFi works. Some exchanges like Bybit list UNFI as a tradable asset. That doesn’t mean Unifi Protocol runs the exchange. It just means someone decided to list the token. You’re trading UNFI on Bybit, not using Unifi’s platform. This mix-up is common in crypto. People see a token on an exchange and assume the project runs it.How uTrade Compares to Other DEXs

uTrade’s biggest selling point is cross-chain trading. Most DEXs like Uniswap or PancakeSwap only work on one chain. If you want to swap Ethereum-based tokens for Binance Chain tokens, you need two steps: bridge first, then swap. uTrade does it in one transaction. But here’s the catch: liquidity. Uniswap has billions in liquidity. PancakeSwap has over $1 billion. uTrade? Not even close. As of late 2025, its total value locked (TVL) is under $50 million. That means slippage can be high, and large trades might not go through smoothly. Also, user experience isn’t polished. The interface is functional but clunky. There’s no mobile app. No guided tutorials. If you’re not already comfortable with MetaMask, wallet connections, and network switching, you’ll struggle. Most retail traders avoid it.

UNFI Token Price and Market Reality

As of October 2025, UNFI trades around $0.14 on Bybit. That’s down from its all-time high of over $10 in 2021. The market isn’t bullish. The Relative Strength Index (RSI) hovers near 40 - neutral, but with a downward trend. The 200-day moving average is falling. Price predictions are all over the place. CoinLore says UNFI could hit $246 by 2036. TradingBeast says it’ll hit $14.88 by December 2025. CoinCodex forecasts $0.176. Kraken’s model says $0.15 by 2026. Swapspace.co calls it a "Sell" with a -3% ROI. These aren’t forecasts - they’re guesses. No one knows. What we do know is this: UNFI failed a periodic review on CoinMarketCap in April 2025 due to "low user interest and trading." That’s code for: not enough people are using it, so exchanges might delist it.Stablechain: The Real Bet for the Future

Unifi Protocol’s most interesting project isn’t uTrade. It’s Stablechain - a proposed blockchain where gas fees are paid in stablecoins like USDC or DAI, not in UNFI or ETH. Right now, using DeFi means paying fees in volatile tokens. If ETH spikes, your swap costs $50. If it drops, it’s $2. That’s unpredictable. Stablechain aims to fix that. If it works, it could attract businesses and apps that need stable costs - think payroll, subscriptions, or DeFi integrations. But here’s the problem: no one’s seen it live. No testnet. No code release. No timeline. It’s a promise. And in crypto, promises without progress are dangerous.

Who Should Use Unifi Protocol?

You should only interact with Unifi Protocol if:- You’re comfortable with DeFi and self-custody wallets

- You need to swap tokens across chains without bridging

- You’re willing to accept low liquidity and high slippage

- You’re not expecting customer support or refunds

Where to Trade UNFI and What to Watch For

UNFI is listed on a few exchanges: Bybit, Bitrue, and a couple of smaller DEXs. Always check the network before depositing. UNFI exists as both ERC-20 (Ethereum) and BEP-20 (BSC). Send the wrong version, and your tokens vanish. Watch for:- Delisting announcements - if UNFI disappears from more exchanges, that’s a red flag

- Updates on Stablechain - if they release testnet code, that’s a positive sign

- TVL growth - if uTrade’s locked value jumps past $100 million, adoption might be picking up

The Bottom Line

Unifi Protocol DAO isn’t a crypto exchange. It’s a niche DeFi project trying to solve a real problem - cross-chain trading - but it’s struggling to gain traction. The UNFI token is a governance tool with little demand. The ecosystem is underfunded, underused, and underpromoted. If you’re looking for a simple way to trade crypto, stick with centralized exchanges. If you’re a DeFi power user who needs cross-chain swaps and doesn’t mind the risk, uTrade might be worth a small test. But don’t bet your portfolio on UNFI. The market isn’t convinced it’s worth it.Is Unifi Protocol DAO a crypto exchange?

No. Unifi Protocol DAO is a decentralized finance ecosystem that includes uTrade, a cross-chain decentralized exchange (DEX). It does not operate as a centralized exchange like Binance or Coinbase. You cannot deposit fiat, get customer support, or recover lost funds through Unifi Protocol.

What is the UNFI token used for?

UNFI is the governance token for Unifi Protocol DAO. Holders can vote on protocol upgrades, fee changes, and new features. It is not a currency for everyday spending. The utility token UP is used for paying fees within the ecosystem.

Can I trade UNFI on Binance or Coinbase?

No. UNFI is not listed on Binance or Coinbase. As of late 2025, it’s available on smaller exchanges like Bybit and Bitrue. Always verify the network (ERC-20 or BEP-20) before depositing to avoid losing your tokens.

Is uTrade better than Uniswap or PancakeSwap?

Only if you need to swap tokens across different blockchains in one step. For single-chain swaps, Uniswap and PancakeSwap have far more liquidity, lower slippage, and better user interfaces. uTrade’s main advantage is cross-chain functionality - but it lacks volume and reliability.

Why is UNFI’s price so volatile and unpredictable?

UNFI has low trading volume and limited adoption. With few buyers and sellers, even small trades can move the price dramatically. Many price predictions are speculative and lack credible methodology. The token’s value is tied to future promises (like Stablechain), not current usage.

Should I invest in UNFI?

Only if you’re comfortable with high risk and low liquidity. UNFI has no strong fundamentals, minimal user base, and faces delisting risks. It’s not a good long-term investment. Treat it as a speculative bet on the success of Stablechain - which hasn’t been proven yet.

What’s Stablechain, and why does it matter?

Stablechain is a proposed blockchain by Unifi Protocol where gas fees are paid in stablecoins like USDC instead of volatile native tokens. If built, it could make DeFi more predictable for businesses and apps. But as of late 2025, there’s no code, testnet, or timeline - it’s still just an idea.