SHDX Token: What It Is, Where It's Used, and What You Need to Know

When you hear SHDX token, a blockchain-based digital asset designed for decentralized network operations and governance. It's also known as Shidax, it's not just another coin — it's a functional piece of infrastructure in certain DeFi and layer-2 ecosystems. Unlike meme tokens that live and die on hype, SHDX was built to solve a specific problem: enabling secure, low-cost communication between blockchain nodes without relying on centralized intermediaries. It powers access, voting rights, and transaction fee discounts in niche networks that prioritize speed and censorship resistance.

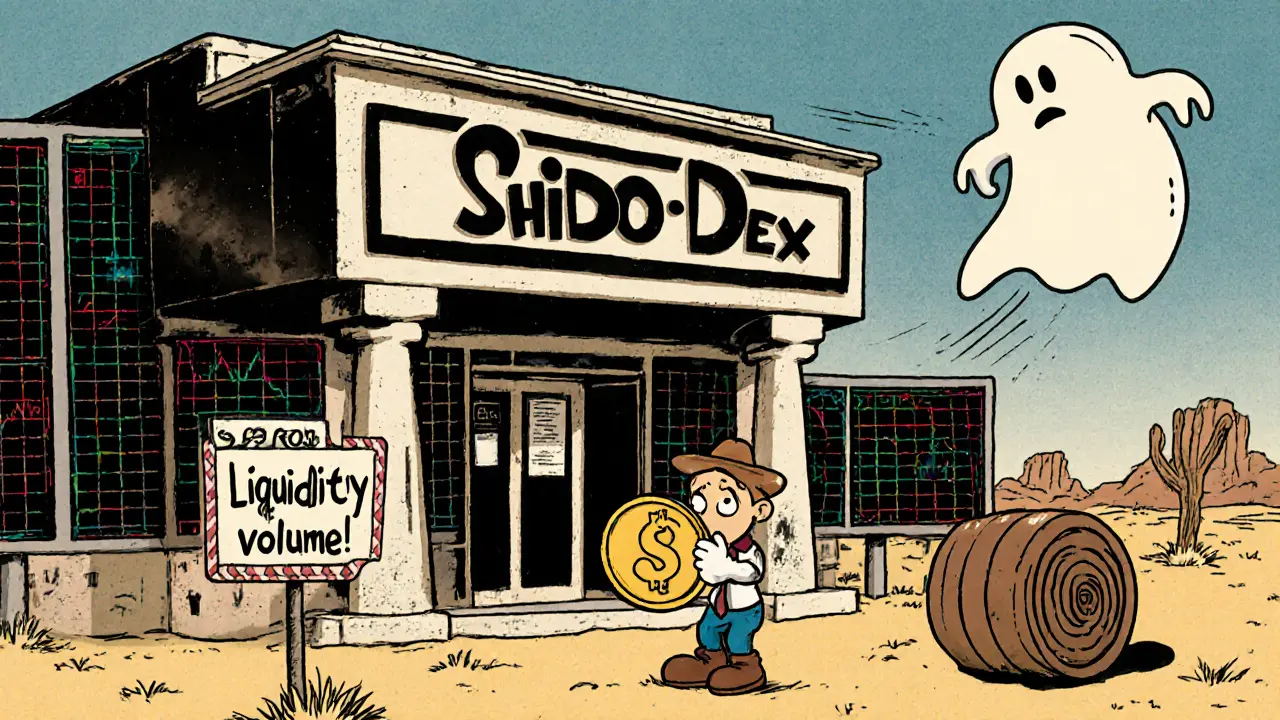

SHDX doesn’t exist in a vacuum. It relates directly to blockchain infrastructure, the underlying systems that keep decentralized networks running without central control, and works alongside DeFi protocols, financial applications that operate without banks or brokers. Many users interact with SHDX through wallets that support ERC-20 or similar standards, and it’s often staked to earn rewards or locked to gain governance power. You won’t find it on Coinbase or Binance — it’s traded on smaller, specialized exchanges that cater to protocol-specific tokens. That means liquidity is thin, price swings are common, and holding it requires understanding the project’s roadmap, not just the chart.

What makes SHDX different from other obscure tokens is its focus on real network utility. It’s not just a speculative asset — it’s a key that unlocks features inside its native ecosystem. Holders can propose upgrades, vote on fee structures, or even earn a share of protocol revenue depending on how the team designed the tokenomics. But here’s the catch: if the network doesn’t grow, the token loses its reason to exist. That’s why tracking its adoption — how many nodes use it, how many wallets hold it, whether developers are still building on it — matters more than any price prediction.

There’s no official whitepaper or team announcement that’s easy to find, which is why many people get confused. Some think it’s a new altcoin with big potential. Others assume it’s a dead project. The truth lies somewhere in between. SHDX is still active in a small but dedicated corner of the blockchain world. It’s used by developers building privacy-focused apps, by validators running nodes in low-fee networks, and by traders who specialize in under-the-radar assets. It’s not for beginners. But if you understand how tokenized governance works, and you’re looking for something beyond the usual suspects, SHDX might be worth your attention.

Below, you’ll find real stories from people who’ve interacted with SHDX — some made money, some lost it, and others just learned what not to do. These aren’t hype pieces. They’re after-the-fact breakdowns of what actually happened when users engaged with this token. Whether you’re holding it, considering buying, or just curious why it shows up in your wallet, the posts here will give you the unfiltered truth — no fluff, no promises, just facts from the field.

Categories