Private Market Access: How to Tap Into Exclusive Investment Opportunities

When working with private market access, the ability to invest in non‑public assets such as early‑stage startups, tokenized securities, or closed‑end funds. Also known as private market entry, it bridges the gap between everyday investors and the world traditionally reserved for institutions. Venture capital, early‑stage funding pools that back innovative companies often serves as the first gateway, while tokenized assets, digital representations of real‑world equity or debt provide the technical bridge that lets you buy a slice on a blockchain.

Key Components of Private Market Access

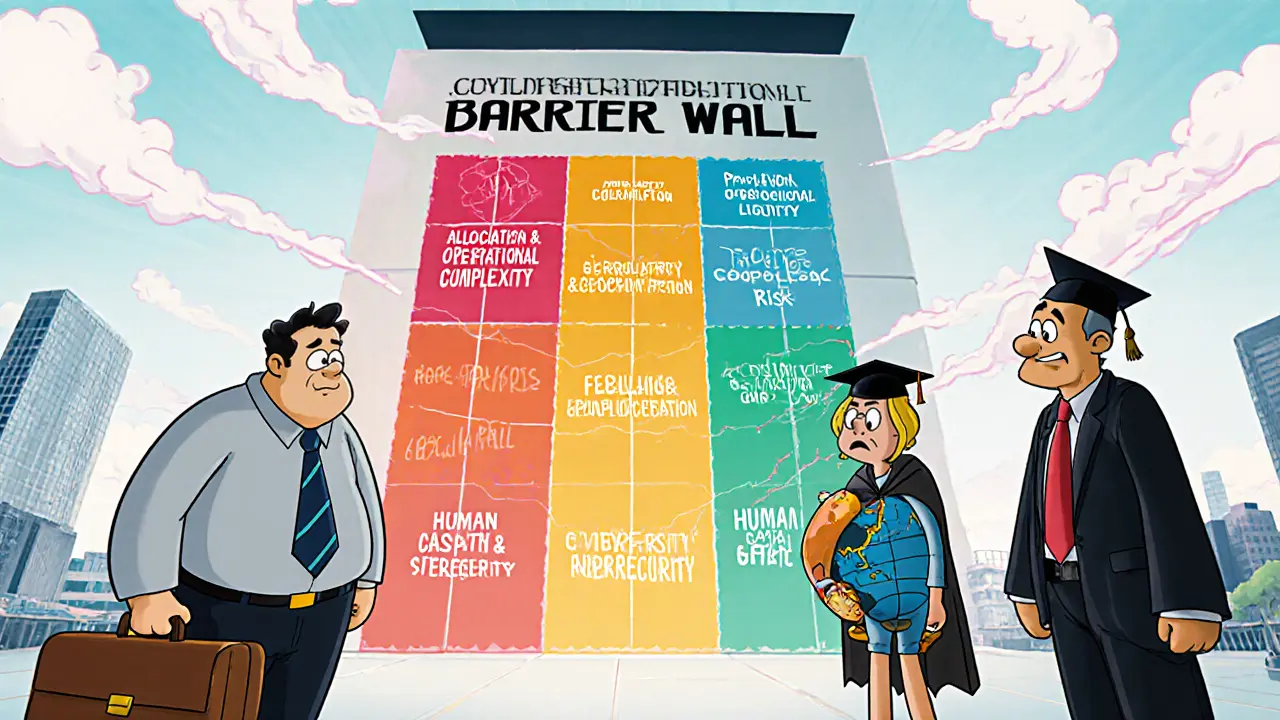

Getting into private markets isn’t a single step; it involves a stack of related pieces. Secondary markets, platforms where already‑issued private securities are traded give liquidity that was impossible a decade ago. Fundraising platforms, online services that run compliant token sales or private placements handle KYC, AML and investor accreditation so you stay on the right side of the law. Together they create a pipeline: a startup raises capital via a fundraising platform, receives venture‑capital backing, tokenizes its equity, and later lists that token on a secondary market for broader investor participation.

Regulation is the glue that holds the whole system together. In India, for example, the FIU‑IND guidelines force exchanges to verify every investor’s identity before any private token sale can happen. In the US, the SEC’s Rule 506(b) and 506(c) describe exactly who can buy unregistered securities, shaping how fundraising platforms design their investor onboarding. Understanding these rules isn’t optional – it determines whether your investment will survive a compliance audit or get frozen.

Technology also plays a big role. Cross‑chain bridges let you move tokens from a high‑speed network like Harmony to a more established chain like Ethereum, expanding the pool of potential buyers. Smart contract audits ensure the token logic matches the promised rights, protecting you from rug pulls. When a project like Wrapped Harmony (WONE) launches, the token’s smart contract acts as a “receipt” for the underlying asset, making the token tradable on any DEX while still representing the original chain’s value.

Risk management looks different in private markets than in public ones. Impermanent loss, a familiar term for liquidity providers on AMM DEXes, can also affect tokenized equity if price volatility is high. Diversifying across multiple tokenized assets, using secondary market data to gauge liquidity, and checking audit reports are practical steps you can take right now. In our own guide on impermanent loss, we break down the math and show how fees can offset the downside in a real‑world scenario.

Another practical piece is the fee structure. Unlike traditional venture capital where fees are hidden in management and performance percentages, tokenized platforms usually show a flat transaction fee, a small protocol fee, and sometimes a liquidity provider incentive. Knowing exactly how much you’ll pay helps you compare options like Switcheo Network DEX versus centralized exchanges such as Upbit, which faced massive KYC penalties for compliance lapses.

All these elements—venture capital, tokenized assets, secondary markets, fundraising platforms, and regulatory frameworks—interact to create a functional private market ecosystem. By the end of this page you’ll see how each piece fits, why the relationships matter, and where you can start exploring today. Below you’ll find articles that dive deep into cross‑chain tokens, DeFi reward models, crypto regulations in key jurisdictions, and step‑by‑step guides to claim airdrops that often serve as a low‑risk entry point into tokenized private equity. Ready to jump in? Let’s get you equipped with the right knowledge and tools.

Categories