Smart Contract Rug Pull Detection Tool

- Identify the development team ✓

- Verify liquidity lock duration ✓

- Inspect smart contract ✓

- Check token distribution ✓

- Research community sentiment ✓

When you hear the term Smart Contract Rug Pull is a deceptive exit scam where a token’s creator drains liquidity or blocks sales through malicious code embedded in the smart contract, the warning bells should start ringing. In the fast‑moving world of DeFi, these scams have cost investors billions, yet many still fall prey because the tricks look like ordinary project launches. This guide breaks down the three core mechanisms, shows real‑world examples, and gives you a practical checklist to stay safe.

Key Takeaways

- Rug pulls fall into three technical families: liquidity pulls, honeypots, and pump‑and‑dump scams.

- Liquidity pulls are the simplest and most common; they vanish the pooled ETH/BNB in seconds.

- Honeypots let you buy but lock the sell function, trapping funds forever.

- Pump‑and‑dump relies on massive insider supply and coordinated selling rather than contract bugs.

- Watch for missing liquidity locks, admin‑only functions, and concentration of token ownership above 50%.

How Rug Pulls Work: The Three Core Mechanisms

All three methods exploit the trust‑less nature of blockchain, but they target different layers of a DeFi token’s ecosystem.

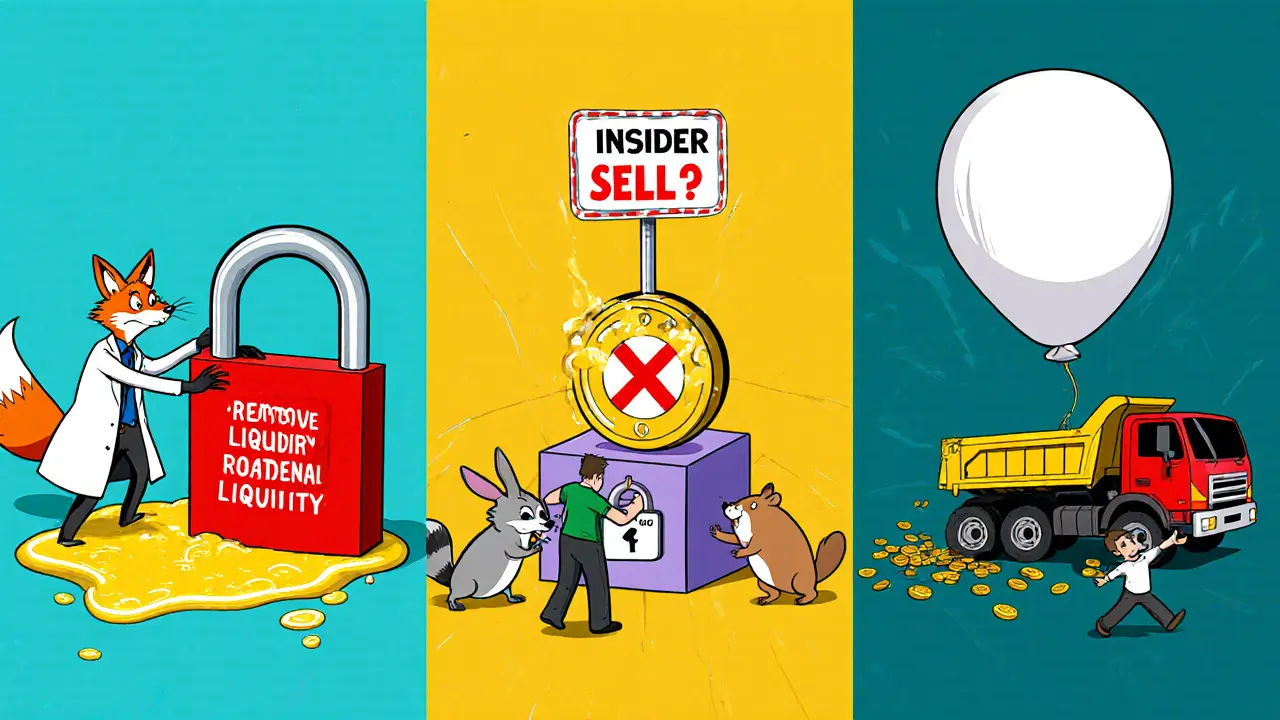

Liquidity Pull

The classic Liquidity Pull is a technique where developers remove the paired assets from a decentralized exchange pool, leaving token holders with a worthless coin. The usual flow looks like this:

- Deploy a new token contract.

- Add initial liquidity on a DEX such as Uniswap, pairing the new token with ETH or BNB.

- Run aggressive marketing to drive deposits into the pool.

- When the pool is sufficiently funded, the creator calls

removeLiquidity(or a custom function) that instantly transfers the paired assets to their wallet. - The token price collapses, and investors are left with a dead coin.

Because the remove‑liquidity call is a standard function in the DEX’s router contract, the transaction often looks legitimate in blockchain explorers until it’s too late.

Honeypot Token

A Honeypot token creates a one‑way street: you can buy, but you can’t sell. The smart contract embeds a whitelist that only authorizes the developer’s address to execute transferFrom for sells. Any other address receives a revert error.

Technical red flags include:

- Modifier functions that check

msg.sender == ownerbefore allowing a sell. - Custom

_transferlogic that throws unless the recipient is on an approved list. - Absence of a standard

ERC20transferimplementation.

Because the token can be purchased on a DEX without any lock, first‑time buyers see a rapid price spike, only to discover later that every sell attempt fails. The developer then empties the liquidity pool or sells the accumulated tokens on a centralized exchange.

Pump and Dump (Soft Rug Pull)

The third family, often labeled a Pump and Dump, doesn’t rely on contract bugs. Instead, the creators allocate a massive share of the total supply-sometimes 70‑80%-to their wallets and then hype the token across socials.

Key steps:

- Launch the token with a modest public supply.

- Publish a slick website, community channels, and sometimes celebrity endorsements.

- FOMO drives retail investors to buy, inflating the price.

- Insider wallets execute cascade sell orders, flooding the market.

- The price crashes, leaving late buyers with heavy losses.

Because no code is malicious, traditional audits won’t flag a problem-only token distribution analysis can reveal the danger.

Real‑World Cases: SQUID and LIBRA

The SQUID token incident in 2021 showcases a hybrid of liquidity pull and honeypot tactics. Analysis by TRM Labs revealed that the contract gave the creator an ownerOnly function to call removeLiquidity at any time, while also embedding a sell‑whitelist that blocked all non‑owner addresses.

Investors collectively lost an estimated $3.38million when the liquidity vanished and remaining holders found they couldn’t sell.

Fast forward to February2025, the LIBRA token-promoted by Argentine President JavierMilei-exemplified a pure pump‑and‑dump. Insiders controlled about 82% of the supply and cashed out $107million within hours, causing a 95% price drop. The case highlighted how political or celebrity hype can amplify traditional pump‑and‑dump dynamics.

Comparison of Rug Pull Mechanisms

| Aspect | Liquidity Pull | Honeypot | Pump & Dump |

|---|---|---|---|

| Technical complexity | Low - uses standard DEX router functions | High - custom transfer restrictions | Medium - requires tokenomics design |

| Detection difficulty | Hard until execution | Medium - audit can catch whitelist | Easy - check token distribution |

| Typical loss size | Thousands to millions of USD | Often smaller but total loss of holdings | Variable, can reach tens of millions |

| Common platforms | Uniswap, PancakeSwap | Uniswap, custom DEXes | Any DEX with low entry barriers |

Warning Signs & Detection Tips

Spotting a rug pull before you invest saves you from a painful loss. Keep an eye on these red flags:

- Anonymous developers - no verifiable team or LinkedIn profiles.

- No liquidity lock - check if the liquidity pool is locked for months or years.

- Owner‑only functions - audit the contract for functions that only the creator can call (e.g.,

removeLiquidity,mint). - Concentrated token ownership - if a single address holds >50% of supply, expect a dump.

- Unrealistic promises - guaranteed returns or “revolutionary” tech with no code demo are suspect.

Technical tools that help:

- Liquidity‑lock explorers (e.g., Unicrypt, Team Finance) to verify lock status.

- Smart‑contract scanners (e.g., Etherscan’s contract tab, Sourcify) to view source and admin functions.

- Token distribution visualizers that highlight top holder percentages.

Tools & Prevention Strategies

The industry is fighting back with automation. Here are the most useful resources for everyday investors:

- Audit services - platforms like CertiK or Hacken can provide a free report on new contracts.

- Real‑time monitoring bots - Discord or Telegram bots that alert when large withdrawals happen from a liquidity pool.

- Liquidity lock checkers - plug the token address into a lock‑status site; if the lock expires in less than 30days, stay away.

- Community due‑diligence sites - Reddit’s r/DeFi and specialized Discord servers share lived‑experience reports.

Even with these tools, never invest more than you can afford to lose. Diversify across established protocols and keep a portion of your portfolio in well‑audited assets.

Quick Checklist for Safe Token Investing

- Identify the development team - look for verifiable social profiles.

- Verify liquidity lock duration and lock‑provider address.

- Inspect the smart contract: do owner‑only functions exist? Is minting unrestricted?

- Check token distribution - are top holders <50%?

- Search for independent audits - read the executive summary for red flags.

- Test a tiny purchase and attempt a sell on a testnet or small amount before committing.

Frequently Asked Questions

What exactly is a smart contract rug pull?

A rug pull is a malicious exit strategy where the token creator either drains the liquidity pool, blocks token sales, or sells a massive insider stash, leaving investors with a nearly worthless asset.

How can I tell if a token’s liquidity is locked?

Enter the token’s contract address into a liquidity‑lock explorer (e.g., Unicrypt). The tool shows the lock status, lock holder, and unlock date. If no lock appears, treat the token as high risk.

Are honeypot tokens detectable before buying?

Yes. Auditing the contract for sell‑whitelist modifiers or testing a tiny sell on a DEX can reveal the honeypot behavior. Tools like Honeypot.is automate this check.

What red flags indicate a pump‑and‑dump scheme?

Look for a small public supply, a single wallet holding the bulk of tokens, and aggressive marketing that promises huge returns without technical detail. Rapid price spikes followed by massive sell volume are classic signs.

Can I recover funds after a rug pull?

Unfortunately, blockchain transactions are immutable. Once a contract executes a withdraw or blocks sales, the funds are gone. Prevention and early detection are the only reliable defenses.