Liquidity Mining

When working with Liquidity Mining, the practice of earning token rewards by providing capital to decentralized finance pools. Also known as LP mining, it lets users turn idle assets into income streams while supporting market depth.

How It Works and What to Watch

Liquidity mining encompasses Yield Farming, a broader strategy where farmers chase the highest returns across multiple protocols.

To participate, you need an AMM, automated market maker that swaps tokens using liquidity pools instead of order books. The AMM’s algorithm determines pricing and fee distribution, which directly feeds your rewards.

Rewards are driven by Token Incentives, native tokens that protocols mint and distribute to liquidity providers as a lure and governance tool. These incentives influence how much capital flows into a pool and shape the overall health of the DeFi ecosystem.

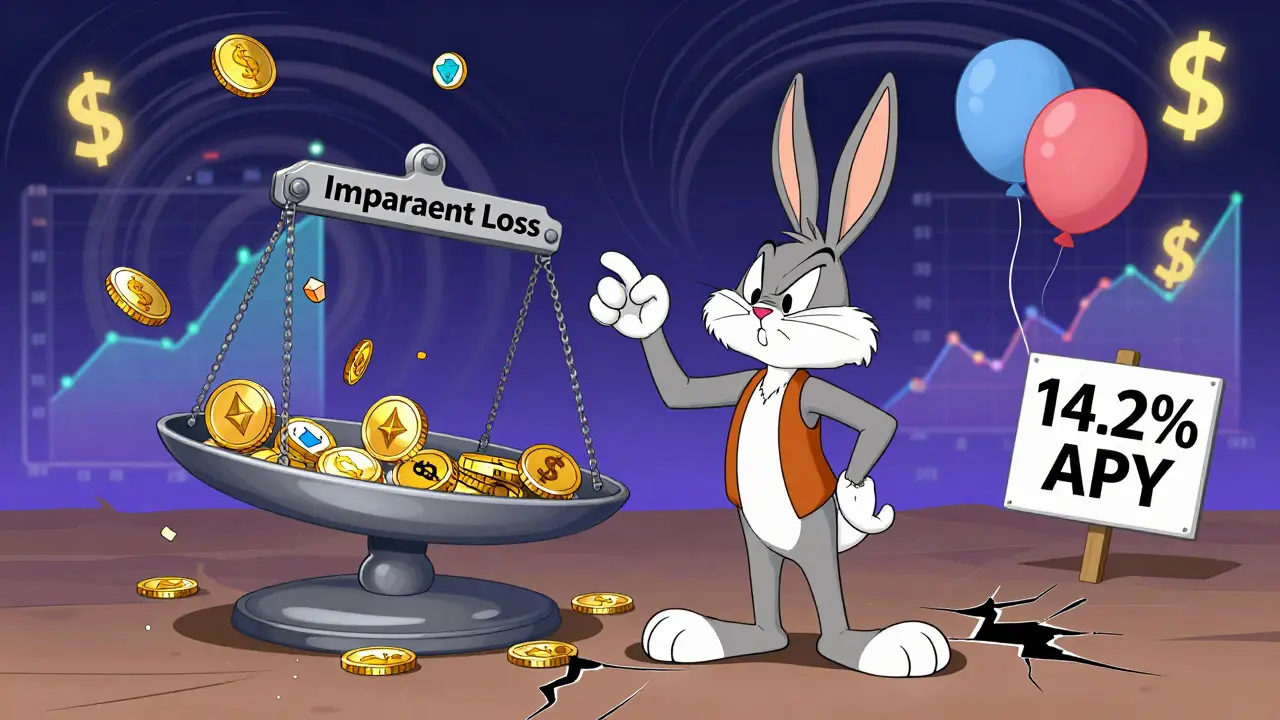

Every time you lock assets, you face Impermanent Loss, the value erosion that occurs when the relative price of supplied tokens shifts. This risk affects your net earnings and must be weighed against the promised token incentives.

Putting it together, liquidity mining requires understanding AMM mechanics, evaluating token incentive structures, and managing impermanent loss. It’s a balancing act: higher incentives can offset loss, but volatile markets can still eat into returns.

Below you’ll find a curated set of guides, reviews, and deep dives that break down each piece of this puzzle. Whether you’re hunting the best farms, learning how to calculate impermanent loss, or comparing protocol fees, the articles ahead give you the practical insight you need to decide if liquidity mining fits your strategy.

Categories