NUSA Token Analysis Calculator

Token Metrics

Risk Assessment

- Liquidity Risk High

- Centralization Risk Medium

- Price Manipulation Risk High

- Regulatory Uncertainty Medium

- Multi-chain Complexity Low

Price Range (Oct 2025)

Across tracking sites

Market Rank

Globally

Platform Features

- DeFi Tools

- NFT Marketplace

- Mobile Super-app

- BEP-20 Token

- Polygon Integration

Comparison with Major DeFi Tokens

| Metric | NUSA | PancakeSwap (CAKE) | Uniswap (UNI) |

|---|---|---|---|

| Primary Chain | BNB Smart Chain (BEP-20) | BNB Smart Chain (BEP-20) | Ethereum (ERC-20) |

| Market Cap (Oct 2025) | ~$0.73M | ~$1.5B | ~$6.2B |

| 24h Volume | ~$200 | ~$300M | ~$500M |

| Total Supply | 104,480 NUSA | 237M CAKE | 1B UNI |

If you’ve seen headlines about a new Nusa crypto token and wondered what it actually does, you’re in the right place. This guide breaks down the basics, the tech behind it, how you can start using it, and the risks you should know before putting any money in.

Quick Facts

- Native token of a Web3 platform that bundles DeFi, NFT marketplace and a mobile super‑app.

- Runs on BNB Smart Chain as a BEP‑20 token.

- Total supply: 104,480NUSA; circulating supply: 0NUSA (as of Aug2025).

- Market cap under $1million; rank~4,433 globally.

- Price varies between $7.85-$8.67 across tracking sites (Oct2025).

What Is Nusa (NUSA)?

Nusa (NUSA) is a cryptocurrency token that powers a multi‑service Web3 ecosystem. The platform markets itself as a one‑stop solution where users can lend, swap, farm, buy NFTs, and manage everything through a single mobile app, all without traditional account registration.

How Nusa Fits Into the BNB Smart Chain Ecosystem

The token lives on BNB Smart Chain, a blockchain built by Binance that offers low fees and high throughput. Within this chain, NUSA follows the BEP‑20 token standard, which is Binance’s counterpart to Ethereum’s ERC‑20. BEP‑20 ensures the token can be stored in any compatible wallet, swapped on decentralized exchanges, and integrated into smart contracts without extra layers of code.

Core Services: DeFi, NFT Marketplace, and Mobile Super‑App

The platform’s three pillars each target a different user need:

- Decentralized Finance (DeFi) tools include lending markets, liquidity pools, token swaps, and farming campaigns. Users earn rewards in NUSA and can vote on governance proposals.

- NFT marketplace operates on the Polygon network, offering faster confirmations and lower gas fees than many Ethereum‑based marketplaces. Artists and collectors can mint, list, and trade NFTs directly from the app.

- Mobile super‑app bundles a non‑custodial wallet, DeFi dashboard, and NFT storefront into a single downloadable interface. The goal is to let users manage all Web3 activities without juggling multiple apps.

Tokenomics: Supply, Circulation, and Market Capitalization

The tokenomics are simple on paper: a total supply of 104,480NUSA, with zero tokens reported as actively circulating. This suggests that the majority of tokens are locked, reserved for future ecosystem incentives, or held by the founding team. The low circulating amount creates a perception of scarcity, but it also raises questions about centralization and future price discovery once the tokens are released.

With a market cap hovering under $1million, NUSA sits firmly in the micro‑cap category. Such tokens typically experience high volatility and thin order books, which we’ll explore in the next section.

Market Performance & Liquidity

Price data across three major trackers illustrate the token’s thin trading activity:

- LiquidityFinder.com: $7.97USD, +2.64% 24h, $0trading volume.

- Kriptomat.io: €7.85 ($8.57USD), +1.41% 24h, €146.73 volume.

- CoinCodex: $8.67USD, -3.76% 24h, $50.32 volume, $730,269market cap.

The discrepancies highlight two problems: low liquidity and potential arbitrage opportunities between the few exchanges that list NUSA (primarily PancakeSwapv2). Because the order books are shallow, even modest buy or sell orders can swing the price dramatically.

Risks and Considerations for Investors

Investing in a micro‑cap token like NUSA carries several red flags:

- Liquidity risk - With daily volumes well below $200 on most platforms, exiting a position could be costly or impossible.

- Centralization risk - Zero circulating supply hints that the team holds most of the tokens, which could lead to sudden dumps.

- Price manipulation - Thin order books make it easy for a single whale to push the price up or down.

- Regulatory uncertainty - Smaller projects often lack legal counsel, increasing the chance of future compliance issues.

- Multi‑chain complexity - Users must hop between BNB Smart Chain for token operations and Polygon for NFTs, which can be confusing for newcomers.

Given these factors, treat any exposure to NUSA as a high‑risk, speculative move and only allocate money you can afford to lose.

Getting Started: Wallet Connection and Using the Platform

Unlike many centralized services, NUSA doesn’t require a traditional sign‑up. Here’s a quick step‑by‑step to begin:

- Download a Web3‑compatible wallet (e.g., MetaMask, Trust Wallet) and add the BNB Smart Chain network.

- Visit the official NUSA web portal and click “Connect Wallet.” The wallet will prompt you to approve the connection.

- Once connected, you can explore the DeFi dashboard, stake NUSA in farming pools, or switch to the Polygon network to browse the NFT marketplace.

- If you prefer mobile, install the NUSA super‑app (available for Android; iOS version pending). The app bundles the wallet, DeFi tools, and NFT viewer in one place.

Remember to double‑check contract addresses from the official documentation to avoid phishing copies.

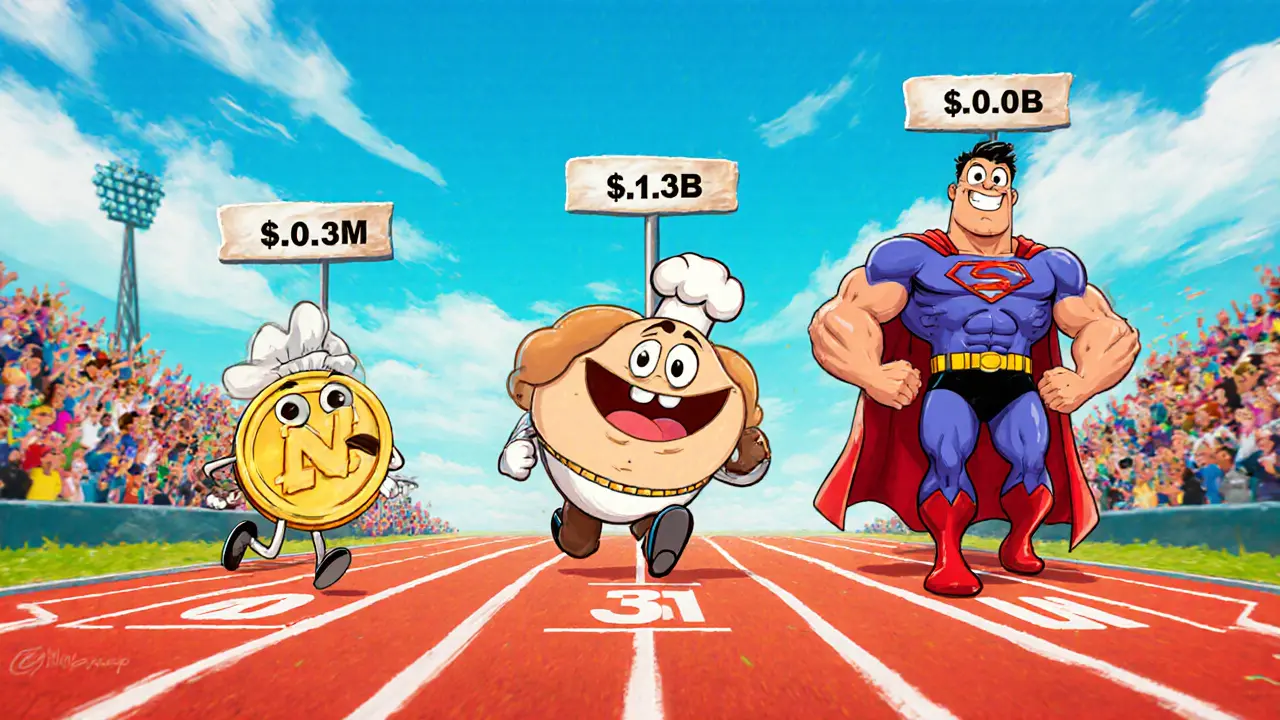

How NUSA Stacks Up Against Bigger DeFi Tokens

| Metric | NUSA | CAKE | UNI |

|---|---|---|---|

| Primary Chain | BNB Smart Chain (BEP‑20) | BNB Smart Chain (BEP‑20) | Ethereum (ERC‑20) |

| Market Cap (Oct2025) | ~$0.73M | ~$1.5B | ~$6.2B |

| 24h Volume | ~$200 | ~$300M | ~$500M |

| Total Supply | 104,480NUSA | 237MCAKE | 1BUNI |

| Liquidity Sources | PancakeSwapv2 (limited) | PancakeSwap, BakerySwap | Uniswap v3, SushiSwap |

As the table shows, NUSA is orders of magnitude smaller than the industry leaders. Its niche appeal lies in the bundled NFT + mobile app offering, but the trade‑off is far less liquidity and higher price risk.

Frequently Asked Questions

What blockchain does NUSA run on?

NUSA is a BEP‑20 token on the BNB Smart Chain. The NFT side of the platform uses Polygon for faster, cheaper transactions.

Is there any NUSA in circulation?

Official data (Aug2025) reports zero circulating tokens. All 104,480NUSA are locked or held by the project team.

Can I buy NUSA on a major exchange?

At the moment NUSA is only listed on decentralized exchanges, mainly PancakeSwapv2. No centralized exchange has added it yet.

What are the biggest risks of investing in NUSA?

Key risks include extremely low liquidity, potential centralization of token holdings, price manipulation due to thin order books, and regulatory uncertainty for micro‑cap projects.

Do I need a special wallet to use the NUSA mobile app?

No special wallet is required. The app includes a built‑in non‑custodial wallet that can connect to external wallets like MetaMask for token swaps.