TWCX Crypto Exchange Risk Assessment Tool

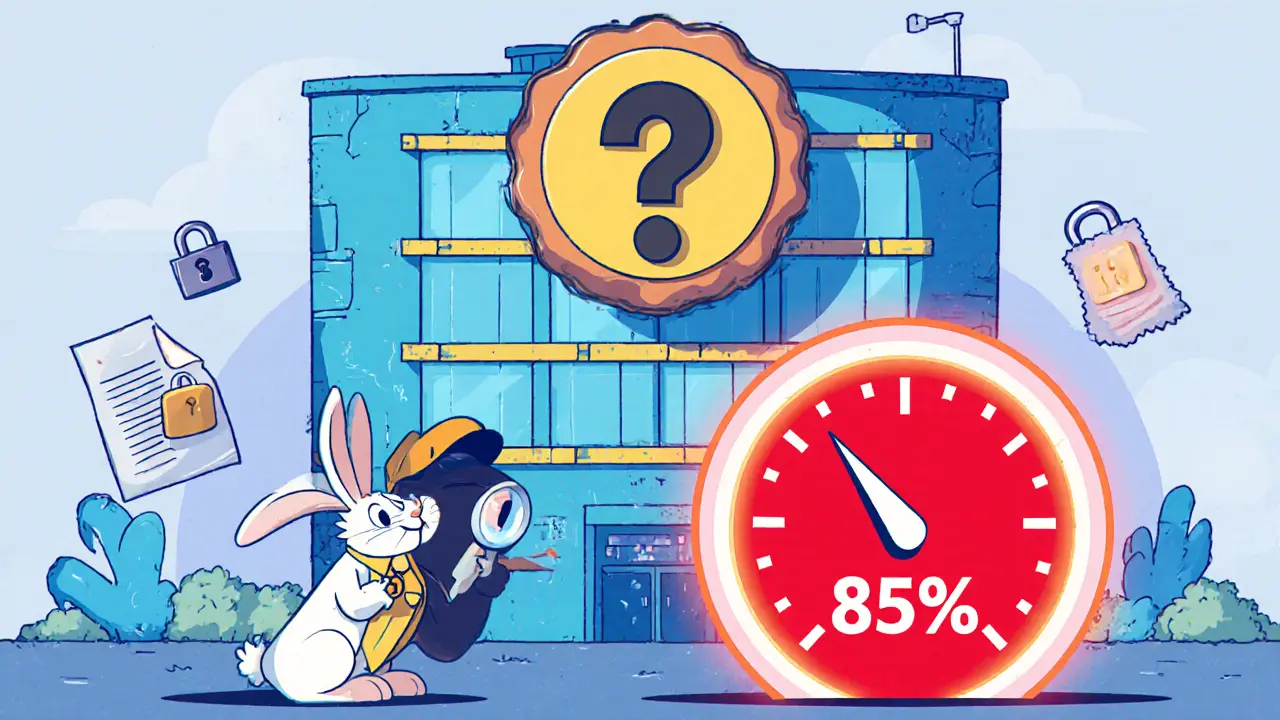

Based on the missing information, TWCX scores poorly on transparency indicators:

Risk Level: High Risk

- Missing Fee Schedule Critical

- No Security Details Critical

- Unclear Regulatory Status High

- No User Support Channels High

- Unknown Asset List High

- No Public Audit Reports Medium

| Exchange | Maker Fee | Taker Fee | Withdrawal Fee (BTC) | Security Claim | Transparency |

|---|---|---|---|---|---|

| Kraken | 0.16% | 0.26% | 0.0005 BTC | Cold storage 95% | High |

| Crypto.com | 0.00%-0.04% | 0.04%-0.14% | 0.0004 BTC | Insurance fund | High |

| TWCX | - | - | - | - | None |

Before considering TWCX, verify these key points:

- Domain security (HTTPS) and branding consistency

- Corporate registration or licensing in claimed jurisdiction

- Fee structure and withdrawal policies

- Third-party security audits

- Community presence on forums and social media

- Support availability and communication

- Mandatory 2FA and withdrawal whitelisting

- Dispute resolution mechanism

Recommendation: Avoid TWCX unless you receive verified documentation addressing all missing factors.

TL;DR

- TWCX crypto exchange exists but public data is extremely scarce.

- No clear fee schedule, security details, or asset list is available.

- Major exchanges like Kraken and Crypto.com provide transparent info; TWCX does not.

- Proceed with caution; verify regulatory compliance before depositing funds.

- Consider established platforms unless you obtain solid proof of TWCX’s legitimacy.

TWCX crypto exchange draws curiosity, but its public profile is almost blank.

What is TWCX crypto exchange?

When evaluating a new platform, the first step is to know what it claims to be. TWCX crypto exchange is described by WikiBit as a “reliable platform for users to engage in virtual currency exchange.” The description is short and does not list any technical specifications, supported cryptocurrencies, or geographic coverage.

Why the information gap matters in 2025

Crypto users today expect real‑time transparency: fee calculators, security audits, and regulatory licenses are usually posted on a platform’s homepage. When an exchange hides these basics, the risk of hidden charges, poor security, or even outright fraud spikes. In a market where billions of dollars move daily, any unknown can become a costly surprise.

What we can confirm

- It is listed on WikiBit, a crowdsourced crypto directory.

- The platform’s branding includes the “TWCX” name; it should not be confused with the defunct “WCX” scam that disappeared in 2020.

- No regulatory filings or licensing information appear in public databases.

- No official blog, social‑media channel, or community forum was found during a comprehensive web search.

Missing pieces that matter

Any crypto exchange should publicly disclose a handful of core details. For TWCX the following are unknown:

- Supported assets - No list of Bitcoin, Ethereum or altcoins is available.

- Fee structure - No maker/taker rates, withdrawal fees, or deposit fees are published.

- Security measures - No mention of cold‑storage ratios, two‑factor authentication, or insurance funds.

- Liquidity and volume - No data from CoinGecko, CoinMarketCap, or similar aggregators.

- Customer support - No ticket system, live chat, or phone line is advertised.

- Regulatory status - No jurisdiction, license number, or AML/KYC policy is disclosed.

- Team and backing - No founder bios, investor names, or office locations are listed.

Security and compliance - what to look for

Established exchanges such as Kraken and Crypto.com publish detailed security whitepapers, attest to regulatory licenses, and undergo regular audits. Because TWCX offers no comparable documentation, users should treat the platform as a “black box” until they can verify:

- Whether the exchange is registered in a jurisdiction with clear AML/KYC rules.

- If it employs hardware‑security‑module (HSM) protected cold wallets.

- Whether it has undergone a third‑party penetration test.

- If it provides an insurance fund that covers custodial losses.

- How it handles data privacy for users in regions such as Wellington, NewZealand, where crypto rules require licensed providers.

Fees & trading costs - the known unknowns

Without a fee schedule, it is impossible to calculate expected trading costs. Below is a comparison that highlights the data gap for TWCX.

| Exchange | Maker fee | Taker fee | Withdrawal fee (BTC) | Security claim |

|---|---|---|---|---|

| Kraken | 0.16% | 0.26% | 0.0005 BTC | Cold storage 95% |

| Crypto.com | 0.00%‑0.04% | 0.04%‑0.14% | 0.0004 BTC | Insurance fund |

| TWCX | - | - | - | - |

The dash marks indicate that TWCX has not published any of these numbers. Until the exchange releases a transparent fee sheet, traders cannot gauge profitability.

User experience and support - what we can infer

Most crypto platforms provide a step‑by‑step onboarding flow: email registration, identity verification, and a dashboard showing balances. No screenshots, tutorial videos, or user guides for TWCX appeared in the search results. Community sites such as Reddit or Trustpilot lack any mention of TWCX, suggesting either a tiny user base or that the exchange is not active.

How TWCX stacks up against the market leaders

Below is a high‑level view of where TWCX sits relative to two well‑documented exchanges.

- Liquidity - Kraken reports daily volumes in the tens of billions of USD; Crypto.com routinely ranks in the top five global exchanges. No volume data exists for TWCX.

- Asset diversity - Both Kraken and Crypto.com list over 200 trading pairs. TWCX’s catalog is unknown.

- Regulatory footing - Kraken is registered in the US, EU, and Japan; Crypto.com holds a Malta license. TWCX provides no jurisdictional information.

- Security track record - No hacks or audit reports are linked to TWCX, but the absence of any public security audit is itself a risk factor.

- User interface - Reviews praise Kraken’s advanced charting and Crypto.com’s mobile app; TWCX’s UI cannot be evaluated without access.

Red flags and a due‑diligence checklist

Because the public footprint is minimal, treat the platform cautiously. Use this checklist before depositing any funds:

- Confirm the domain matches the official branding and is secured with HTTPS.

- Search for a corporate registration number or license in the exchange’s claimed jurisdiction.

- Ask the support team for a detailed fee schedule and security whitepaper.

- Check for independent third‑party audits; request the audit report.

- Start with a very small test deposit and monitor withdrawal speed.

- Look for community chatter on Reddit, Discord, or Telegram channels - silence can be a warning sign.

- Verify that two‑factor authentication (2FA) and withdrawal whitelists are mandatory.

- Make sure the platform offers a clear dispute‑resolution process.

Bottom line - should you try TWCX?

Given the scarcity of verifiable information, the safest recommendation is to keep your capital on exchanges that openly publish fees, security policies, and regulatory status. If TWCX can provide concrete documents answering the gaps listed above, it may become a viable option, but until then the risk remains high. In 2025’s competitive crypto environment, transparency is a non‑negotiable trait for any exchange that wants to earn trust.

Frequently Asked Questions

Is TWCX crypto exchange a scam?

There is no public evidence that TWCX is a scam, but the lack of transparency makes it impossible to verify its legitimacy. Treat it with the same caution you would apply to any unregistered platform.

What cryptocurrencies can I trade on TWCX?

The platform does not publish a list of supported assets, so users cannot know which coins are available until they sign up and explore the dashboard.

How do TWCX fees compare to Kraken or Crypto.com?

Because TWCX has not released any fee information, a direct comparison is not possible. Kraken’s maker fee starts at 0.16% and Crypto.com’s can be as low as 0% for high‑volume traders.

Is TWCX regulated?

No regulatory registration or licensing details are publicly available for TWCX. Potential users should request proof of compliance before trading.

Can I withdraw my funds quickly from TWCX?

Withdrawal speed cannot be evaluated because the platform does not list processing times or provide any user feedback on the matter.