Multi-Chain Cryptocurrency: A Practical Guide

When you hear the term multi-chain cryptocurrency, you’re looking at a digital asset that lives on more than one blockchain. multi-chain cryptocurrency, a digital asset designed to operate on, or move between, multiple blockchain networks. cross-chain cryptocurrency isn’t just a buzzword; it’s a way to tap liquidity, avoid single‑chain bottlenecks, and reach users wherever they trade. To make that happen, you need wrapped token, a representation of an original asset on a different chain, secured by a smart‑contract bridge. Think of Wrapped Harmony (WONE) – the same Harmony coin you know, now usable on Ethereum DeFi platforms. The bridge technology that creates wrapped tokens also powers decentralized exchange, a peer‑to‑peer trading venue that matches buyers and sellers without a central custodian. Switcheo Network, for example, lets you swap tokens across Polkadot, Binance Smart Chain and Ethereum in a single UI. Finally, the economics of moving money across chains are shaped by the block reward system, the incentive model that gives miners or validators transaction fees and newly minted coins. Modern reward models are shifting from fixed halving events to fee‑only or hybrid structures, which directly affect how attractive a cross‑chain bridge is for liquidity providers.

Why Multi‑Chain Matters and How to Use It

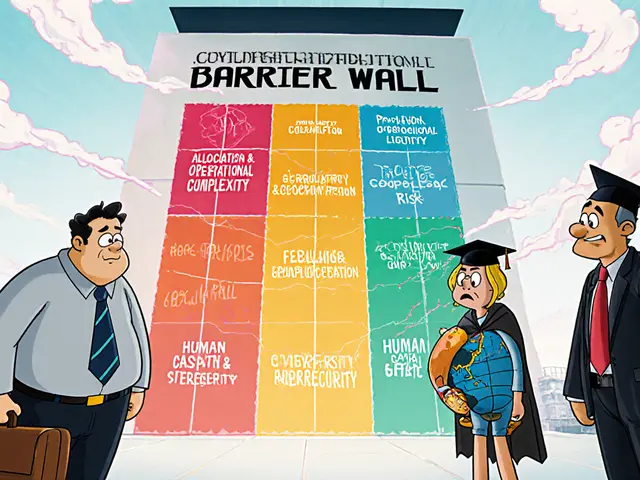

Multi-chain cryptocurrency enables assets to travel between ecosystems, requires reliable bridge contracts, and boosts access to diverse DeFi services. If you hold a token on a saturated chain, you might face high gas fees or limited DEX options. By wrapping that token on a cheaper network, you can farm yields, trade on low‑cost pools, or participate in NFT drops that only accept the wrapped version. The key is to understand the risk profile: bridge contracts can be vulnerable, and wrapped tokens inherit the security assumptions of both the source and destination chains. Look at WONE – it inherits Harmony’s fast finality but also depends on Ethereum’s smart‑contract audit standards. When you trade on a decentralized exchange like Switcheo, you sidestep custodial risk, yet you still need to trust the underlying bridge and the validator set that secures each network. Block reward systems add another layer: chains that rely heavily on transaction fees (like some fee‑only models) may offer lower inflation but could see volatile validator incentives, affecting bridge stability. Conversely, hybrid reward models that blend small block subsidies with fee revenue tend to provide steadier security for cross‑chain operations.

These dynamics shape everything you’ll read in the collection below – from deep dives on wrapped tokens and cross‑chain DEX reviews to analyses of evolving block reward structures and regulatory guidance for multi‑chain traders. Whether you’re hunting the next airdrop, comparing bridge fees, or figuring out how new reward models affect your yield strategy, the articles ahead give you the context and actionable steps you need to navigate the multi‑chain world with confidence.

Categories