Marnotaur Profit Sharing: What It Is and Why It Matters in Crypto

When you hear Marnotaur profit sharing, a blockchain-based revenue distribution system where token holders receive a portion of platform earnings. Also known as profit-sharing tokens, it’s not just another way to buy crypto—it’s a shift from speculation to actual ownership in how a project makes money. Unlike most tokens that rely on price pumps, Marnotaur profit sharing ties your holdings directly to real income, like trading fees, subscription revenue, or service charges. This isn’t theory—it’s a model used by a few serious projects that want users to stick around because they’re earning, not just hoping.

What makes this different from staking or yield farming? Staking locks your coins to secure a network. Yield farming moves your assets between protocols to chase high APYs. Marnotaur profit sharing is simpler: you hold, and you get paid when the platform makes money. Think of it like owning a small piece of a business that pays dividends. The blockchain profit models, structures that distribute revenue directly to token holders via smart contracts. Also known as revenue-sharing tokens, they’re gaining traction because they align incentives: if the platform grows, you grow with it. This reduces pump-and-dump behavior. If you’re getting paid monthly from fees, you don’t care if the price drops 20% tomorrow—you care if the platform keeps attracting users.

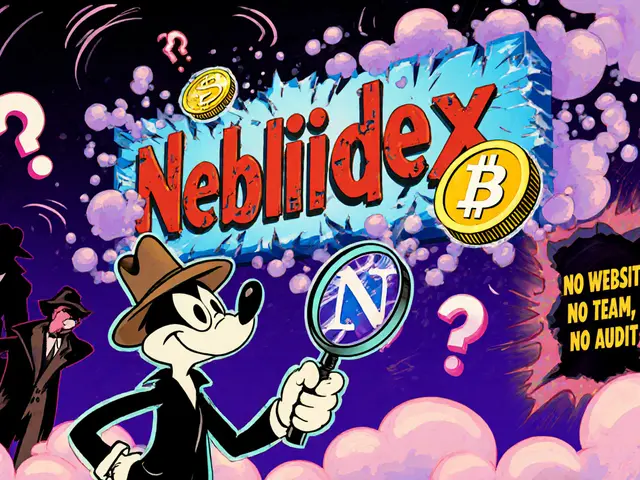

But here’s the catch: most projects claiming "profit sharing" don’t deliver. They publish vague whitepapers, never show audit logs, or hide the payout source. Real profit sharing requires transparency: public wallet addresses, clear fee structures, and regular reports. Projects like these are rare because they’re harder to run. You can’t just mint tokens and hope. You need a working product that actually earns. That’s why you’ll find fewer projects using this model—but the ones that do tend to last longer. It’s also why platforms like decentralized finance, financial services built on blockchain without banks or middlemen. Also known as DeFi, it enables direct user-to-user transactions and revenue flows are the only places where this model has real traction. And even there, it’s still niche.

You won’t find Marnotaur profit sharing on CoinMarketCap’s top 100. But if you’re tired of chasing coins that vanish after a hype cycle, this is the kind of system worth digging into. The posts below cover real cases where profit sharing worked, where it failed, and how to tell the difference before you invest. You’ll see which platforms actually pay out, which ones just talk about it, and what red flags to watch for. This isn’t about getting rich quick. It’s about building something that lasts.

Categories