Geopolitical Risk and Its Impact on Crypto Markets

When dealing with geopolitical risk, you instantly feel the tension between world events and your wallet. Geopolitical Risk, the chance that political moves, sanctions, or conflicts will shift asset values and market behavior is more than a buzzword – it reshapes how regulators act, how exchanges operate, and how investors protect themselves. Also known as global political risk, this factor forces crypto players to watch borders as closely as they watch blockchains.

One of the biggest downstream effects is Regulation, government rules that dictate how digital assets can be created, traded, and taxed. When a country tightens its stance, exchanges must scramble to meet new KYC requirements, as seen in South Korea’s Upbit fines and India’s evolving crypto laws. That scramble leads directly to Compliance, the set of processes and documentation exchanges use to stay legal and avoid penalties. Compliance isn’t just paperwork; it determines whether a platform can stay online or face a $34 billion penalty, as the Upbit story shows.

Taxation, Licensing, and Real‑World Costs

Alongside regulation and compliance, Taxation, the government’s claim on profits, trades, and holdings in digital assets becomes a heavy lift for traders in Nigeria, India, and beyond. New tax acts, like Nigeria’s 2025 crypto tax law, force investors to calculate capital gains on each transaction, turning a simple swap into a tax filing exercise. Meanwhile, licensing bodies such as the Nigerian SEC or India’s FIU demand that exchanges prove they have enough capital and security controls, turning the market entry process into a geopolitical hurdle.

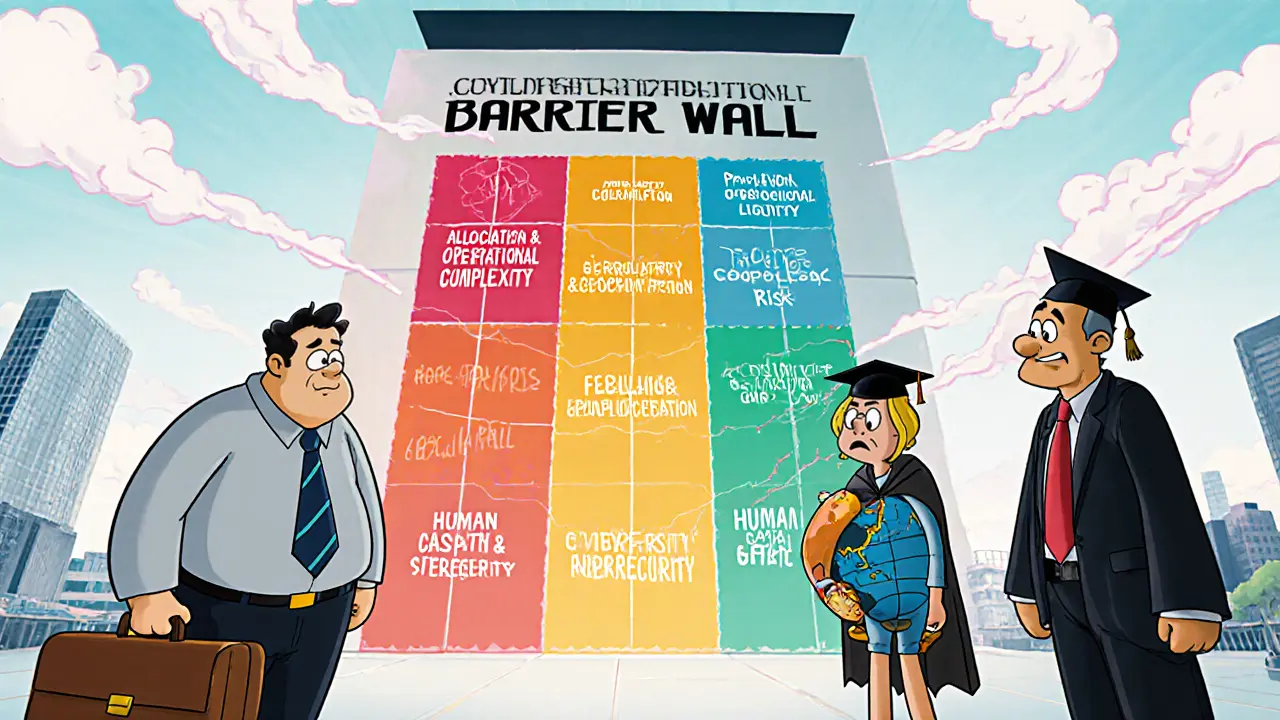

All these forces converge on the Crypto Exchange, the platform where users buy, sell, or trade digital assets. An exchange’s ability to survive depends on its readiness to adapt to shifting geopolitical tides. Whether it’s adding new fiat on‑ramps after a sanction, tightening KYC to avoid fines, or redesigning fee structures to meet tax rules, the exchange is the front line where politics meets profit. This chain of influence—geopolitical risk drives regulation, regulation demands compliance, compliance shapes exchange operations, and taxation adds the final cost layer—creates a loop that every trader should understand.

Below you’ll find a curated collection of articles that break down each piece of this puzzle. From deep dives into KYC failures at Upbit, step‑by‑step guides for staying compliant in India, to the latest Nigerian licensing requirements, the posts give you actionable insights to navigate the ever‑shifting geopolitical landscape. Let’s explore how the world’s politics are rewriting the rulebook for crypto and what you can do to stay ahead.

Categories