EOA Explained: What It Is and Why It Matters in Crypto

When you send ETH from MetaMask or sign a transaction on OpenSea, you’re using an EOA, an externally owned account controlled by a private key, not code. Also known as a user account, it’s the simplest and most widely used way to interact with blockchains like Ethereum. Unlike smart contracts, which run automated code, an EOA is just a public address tied to a secret key you hold. No company, no app, no algorithm owns it—just you.

EOAs are the foundation of nearly every crypto interaction. They let you receive tokens, pay gas fees, trade on DEXs, and claim airdrops. Every time you connect your wallet to a site, you’re using an EOA. But they’re not the whole story. Many crypto projects rely on smart contracts, self-executing programs on the blockchain that can hold and manage assets—and these work differently. While an EOA can only act when you sign a transaction, a smart contract can trigger actions on its own, like releasing funds when conditions are met. That’s why platforms like Compound or Uniswap use smart contracts for lending and swapping, but you still need an EOA to start the process.

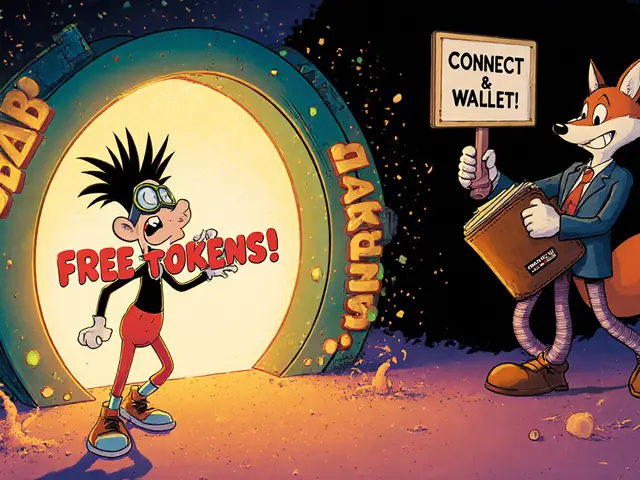

EOAs also have limits. They can’t automatically earn interest, stake tokens, or execute complex logic. That’s why some users now use account abstraction, a next-gen upgrade that lets smart contracts act like wallets—blurring the line between EOA and contract. But for now, if you’re holding ETH, trading NFTs, or joining an airdrop, you’re almost certainly using an EOA. The posts below cover real-world cases where EOA misuse led to scams, where wallet security failed, and how projects like Oasis Swap or Shido DEX relied on user EOA interactions that often ended in losses. You’ll find guides on how to protect your EOA, spot fake airdrops that target wallet addresses, and understand why platforms like Neblidex or XeggeX disappeared—often because they didn’t respect how EOAs actually work.

Categories