Most crypto exchanges let you trade volatile tokens with no real value behind them. Kinesis Money is different. It lets you trade digital gold (KAU) and digital silver (KAG) that are 1:1 backed by physical metal stored in secure vaults. No speculation. No empty promises. Just real assets you can hold, spend, and earn from - without locking anything up.

What Makes Kinesis Money Stand Out?

Kinesis isn’t just another crypto exchange. It’s a monetary system built on sound money principles. While Binance or Coinbase offer hundreds of tokens, most of them are just digital bets with no tangible backing. Kinesis offers two core assets: KAU (gold) and KAG (silver). Every token you buy equals one gram of physical metal stored in audited vaults across Switzerland, Canada, and Singapore.

The platform doesn’t just claim this - it proves it. Bi-annual physical audits verify every ounce of gold and silver backing the tokens. That’s rare. Even many so-called "gold-backed" platforms don’t do this. Kinesis does. And they publish the results publicly.

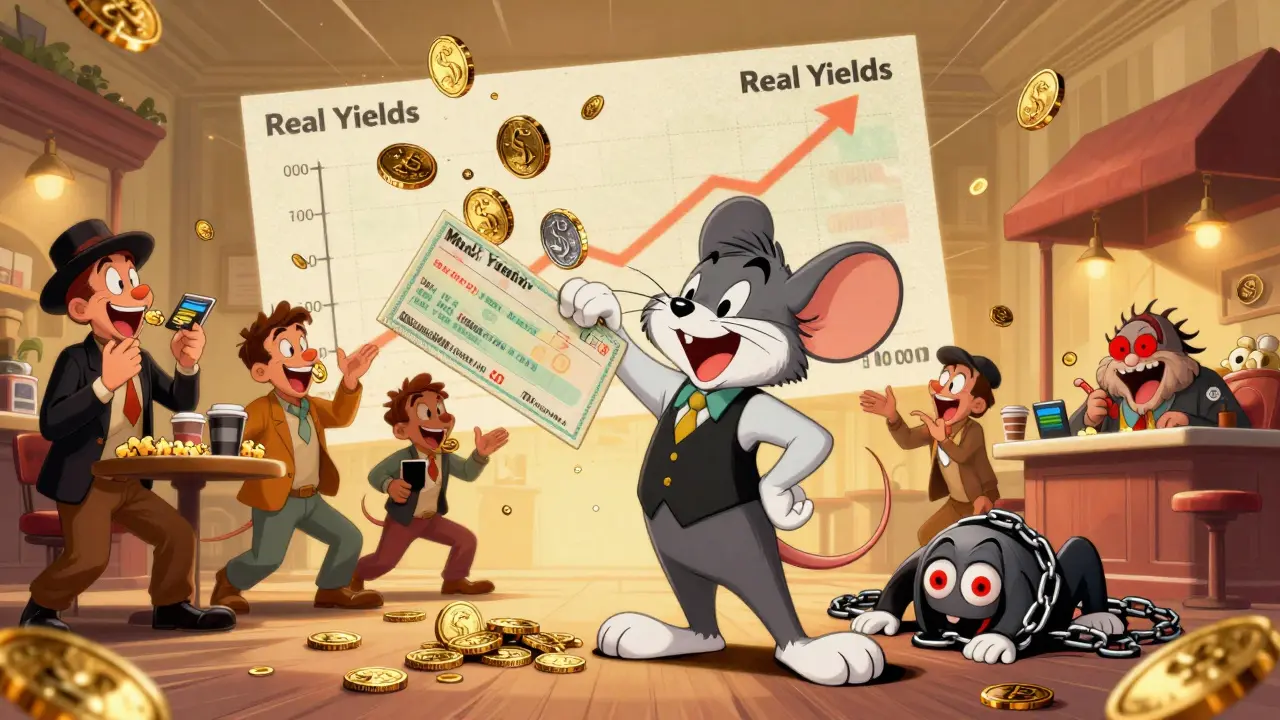

How the Yield System Actually Works

This is where Kinesis breaks the mold. Most crypto platforms promise high yields by printing new tokens - a Ponzi-style model that collapses when new investors stop joining. Kinesis doesn’t do that. Instead, it gives back 57.5% of all global trading fees directly to users - paid monthly in actual gold and silver.

You don’t need to stake. You don’t need to lock your coins. You don’t need to trust a smart contract. You just hold KAU or KAG in your wallet, and every month, you get more of it. If you hold 100 KAU and the platform collects $1 million in fees that month, you’ll get a share of that payout in real gold - no matter how long you’ve held it. It’s compound growth tied to real economic activity, not hype.

That’s why users call it "the birthplace of sustainable yields." No one else in crypto does this. Not even close.

Trading Is Fast, Cheap, and Transparent

Trading fees on Kinesis are among the lowest in the industry. Spreads on gold and silver are razor-thin - often under 0.1%. Compare that to traditional bullion dealers who charge 5-10% premiums. On Kinesis, you buy gold at spot price. No markup. No hidden fees.

Transactions settle in seconds. There are no storage fees. No custody fees. No insurance fees. You own the metal outright. If you want to redeem it for physical bars, you can. Users report smooth, zero-complaint redemptions - something you rarely hear with other precious metals platforms.

The platform also offers C1USD, its updated USD-backed stablecoin (replacing USD1 in September 2025). It’s fully backed, with monthly reserve attestations published. $12 billion in liquidity means you can move in and out of positions without slippage.

Real People, Real Results

Trustpilot shows a 4.4-star rating from over 600 users as of late 2025. That’s not a fluke. People aren’t just signing up - they’re referring friends and moving their entire portfolios over.

One user wrote: "I moved most of my investments to Kinesis and referred other people. Easy to use, no storage fees, and I get paid in gold every month. It’s the next monetary system." Another from Israel called it "the champion of free markets, bringing sound money back to the economy."

Account managers are described as "super coaches" - not salespeople. They help users understand how to use the platform, not push products. That kind of service is rare in crypto.

The Kinesis Card: Spend Your Gold and Silver

You can’t just hold gold and silver - you need to use it. That’s why Kinesis launched its physical and virtual debit card. It lets you spend your KAU and KAG anywhere Visa is accepted. The card converts your precious metals to local currency in real time at live market rates.

Imagine paying for coffee, groceries, or a flight using digital gold. No need to sell first. No waiting for settlement. Just tap and go. It turns your holdings from a savings account into a functional currency.

What’s Missing? Limitations to Know

Kinesis isn’t for everyone. If you want to trade Solana, Shiba Inu, or Dogecoin - this isn’t the place. The platform only supports KAU, KAG, C1USD, and a few other asset-backed tokens. It’s focused, not broad.

It also doesn’t offer margin trading, futures, or complex derivatives. This isn’t a trading floor. It’s a monetary system. If you’re looking for short-term speculation, you’ll be frustrated. But if you want to build long-term wealth with tangible assets - this is one of the few platforms that delivers.

Who Is This For?

Kinesis is ideal for:

- Investors tired of crypto volatility and want real value behind their holdings

- People who believe in sound money and distrust inflationary fiat systems

- Those who want passive income without locking up assets

- Anyone who wants to spend gold and silver like cash

It’s not for day traders. Not for meme coin hunters. Not for people who think crypto is a get-rich-quick scheme.

The Bigger Picture: Sound Money in a Digital Age

Global inflation, central bank debasement, and banking instability have pushed more people to seek alternatives. Kinesis taps into that. It’s not trying to replace Bitcoin. It’s trying to replace the broken banking system.

With operations in 151 countries and physical vaults on three continents, Kinesis has scaled without sacrificing transparency. The fact that it’s registered in London and audited by independent firms adds legitimacy.

Its growth isn’t fueled by hype or marketing. It’s fueled by results: users getting paid in gold, spending it freely, and trusting it enough to move their life savings there.

Final Verdict

Kinesis Money isn’t the biggest crypto exchange. But it’s one of the most honest. It doesn’t promise moonshots. It doesn’t rely on new investors to pay old ones. It doesn’t hide behind complex tokenomics.

It gives you real gold. Real silver. Real yields. Real spending power. All backed by real audits. And it’s free to store.

If you’re looking for a way to protect your wealth from inflation, earn passive income without risk, and use your assets in daily life - Kinesis isn’t just an option. It’s the only one that works this way.

Is Kinesis Money a scam?

No. Kinesis is registered in the UK and undergoes bi-annual physical audits by independent firms to verify that every KAU and KAG token is backed by real gold and silver in secure vaults. Its transparent fee structure and user payouts are built on actual trading revenue, not new investor money. Trustpilot has over 600 reviews with a 4.4-star average, and users consistently report successful physical redemptions.

Can I really get paid in gold and silver every month?

Yes. Kinesis redistributes 57.5% of all global trading fees to users as monthly yields paid in actual gold (KAU) and silver (KAG). You don’t need to stake or lock your assets. Just hold them in your Kinesis wallet, and you’ll receive your share automatically each month. These yields compound over time as you earn more metal, which can appreciate in value.

Are there storage fees for holding gold or silver on Kinesis?

No. Unlike traditional precious metals dealers or custodians, Kinesis charges zero storage fees. Your gold and silver are held in secure, insured vaults at no cost to you. You pay only the minimal trading spread when buying or selling.

Can I withdraw physical gold or silver?

Yes. You can redeem your KAU and KAG tokens for physical bars or coins. The process is straightforward, and users report successful redemptions with no issues. Minimum redemption amounts apply, but the option exists - something most crypto platforms don’t offer.

Is Kinesis better than Binance or Coinbase?

It depends on your goal. If you want to trade hundreds of speculative tokens, Binance or Coinbase are better. If you want to own real assets, earn yields without locking up funds, and spend gold like cash, Kinesis is unmatched. It’s not a competitor - it’s a different system entirely.

What is C1USD?

C1USD is Kinesis’s updated USD-backed stablecoin, launched in September 2025 to replace USD1. It’s 1:1 backed by reserves and undergoes monthly attestations for transparency. It’s used for trading, settling payments, and bridging between precious metals and fiat value on the platform.

Does Kinesis work in my country?

Yes. Kinesis operates in 151 countries, including the US, UK, Canada, Australia, EU nations, and many in Asia and Latin America. Check their website for any local restrictions, but most users worldwide can sign up and use the platform without issue.

How do I start using Kinesis?

Sign up for a free account on the Kinesis website. Complete basic verification (KYC), then deposit funds via bank transfer or crypto. You can immediately buy KAU or KAG at spot price. No minimum deposit. You’ll start earning yields as soon as you hold tokens. The interface is simple - even beginners can navigate it in minutes.