Blockchain Trading: What It Is, How It Works, and Where to Stay Safe

When you trade on blockchain trading, the direct exchange of digital assets using decentralized ledgers without banks or middlemen. Also known as crypto trading, it’s what lets people buy Bitcoin on one side of the world and sell it on the other—without waiting days for a bank to clear the deal. But here’s the catch: just because it’s decentralized doesn’t mean it’s safe. Many platforms claiming to offer blockchain trading are fake, unregulated, or outright scams. You’ll find platforms like BIJIEEX or Neblidex that look real but have no audits, no team, and no customer support. Others, like Oasis Swap or BCoin.sg, vanished overnight after stealing users’ funds. Real blockchain trading happens on platforms that are transparent, regulated, and have a track record—like Biteeu in the EU or Coinbase globally.

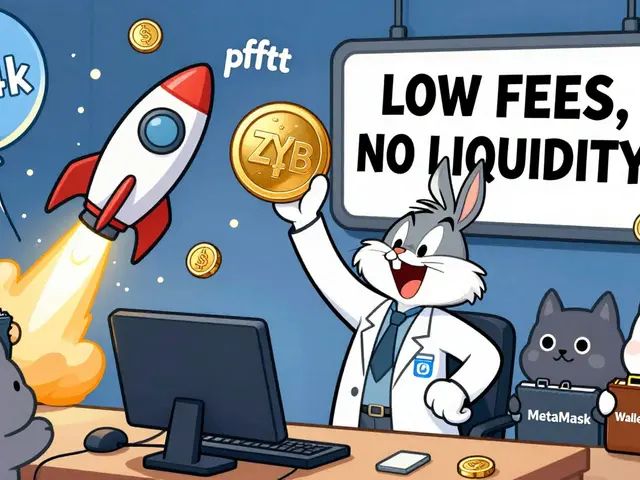

What makes blockchain trading different from stock trading? It’s not just the assets. It’s the infrastructure. decentralized exchange, a platform where trades happen directly between users’ wallets using smart contracts, not a central company’s database. Also known as DEX, it removes the middleman—but also removes customer service if something goes wrong. That’s why so many people get burned. They think ‘no middleman’ means ‘no risk.’ It doesn’t. If you send your crypto to the wrong address on a DEX, it’s gone forever. And if the smart contract has a flaw? Your money can vanish. That’s why real traders check liquidity, audit reports, and community activity before trading. You’ll see this in posts about Shido DEX or Oasis Swap—both had listings but no real users. Meanwhile, platforms like AUSTRAC-registered exchanges in Australia or VASPs in Taiwan follow strict rules because governments demand it. Regulation isn’t the enemy—it’s the filter that separates working systems from fraud.

And then there’s the other side: the scams. crypto scams, fraudulent schemes that trick people into sending crypto or handing over private keys under false promises of free tokens or high returns. Also known as rug pulls or fake airdrops, they’re everywhere. ETHPAD’s GRAND airdrop? Doesn’t exist. BAKECOIN? A copycat. Unbound NFTs? A phishing trap. These aren’t mistakes—they’re designed to look like real opportunities. And they target people who don’t know how to spot the red flags: no team, no whitepaper, urgent deadlines, and always, always asking you to send crypto first. The same people who trade on blockchain networks also need to know how to protect themselves. That’s why posts on Iranian rial restrictions, Namibia’s banking bans, or Taiwan’s crypto rules matter—they show how real-world laws shape what’s possible, and what’s dangerous.

Blockchain trading isn’t magic. It’s code, rules, and human behavior. Some parts work well—like Ethereum’s fee burning or NFT ticketing stopping scalpers. Others are just wild west—like meme coins on Solana or low-cap tokens on TON with $30,000 market caps. This collection doesn’t just list platforms. It shows you what to avoid, what to verify, and how to trade without losing everything. Below, you’ll find real reviews, real failures, and real lessons from people who got burned—and those who learned how to stay safe.

Categories