Airdrop Legitimacy Checker

Assess whether a cryptocurrency airdrop is likely legitimate by checking key indicators of project credibility. Based on the SIL Finance airdrop analysis in the article.

There’s a lot of noise around crypto airdrops. Some are legitimate, some are scams, and others are just ghost projects with no real activity. If you’ve seen headlines about the SIL Finance airdrop, you’re probably wondering: Is this real? Can I actually get free tokens? And should I bother?

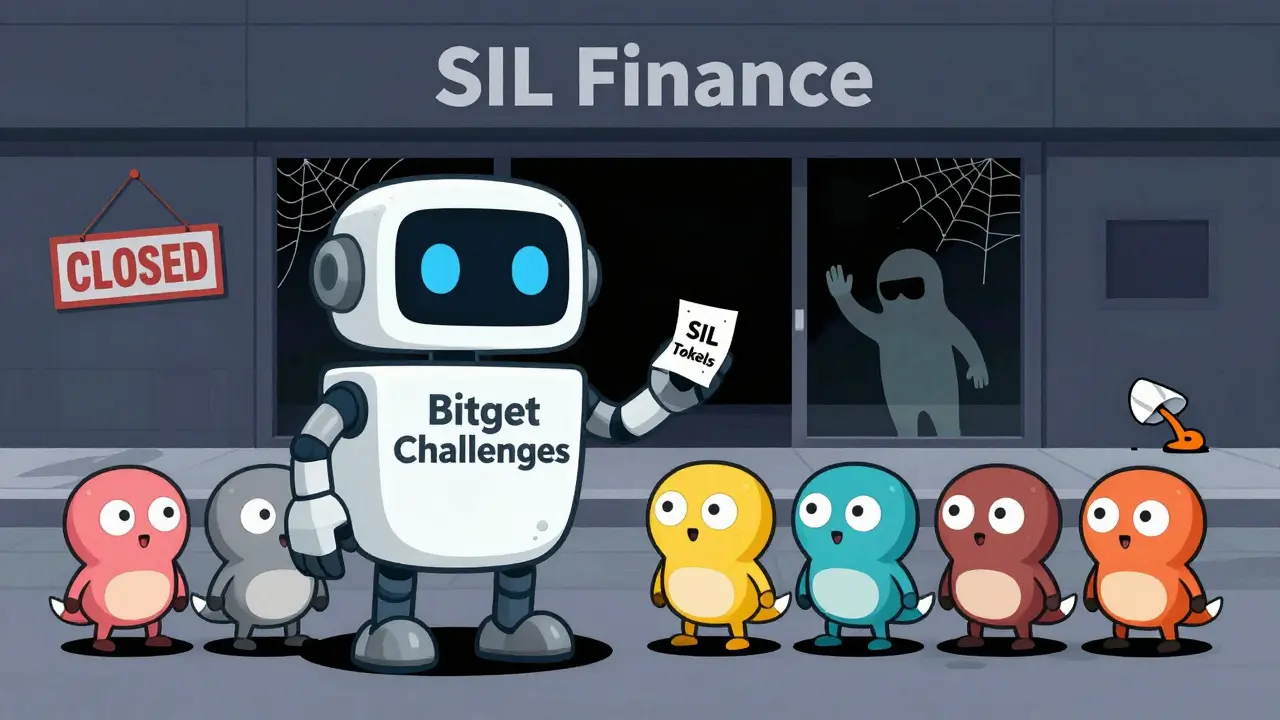

The short answer: it’s unclear. The SIL Finance project exists on paper, but its market presence is almost invisible. You’ll find conflicting data everywhere - one site says SIL is worth $21, another says it’s worth $0. No trading volume. No active community. And yet, Bitget claims you can get free SIL tokens by joining challenges. So what’s going on?

What Is SIL Finance?

SIL Finance, sometimes called "Sister In Law," is a DeFi project designed to simplify yield farming. It doesn’t ask you to manually jump between platforms like YFI or YFII to chase the best returns. Instead, it automatically picks the most profitable and safest liquidity pools for you based on factors like annual yield, risk level, and how long your funds are locked up.

Think of it like a financial assistant for crypto farmers. You deposit your assets, and SIL Finance handles the rest - rebalancing, compounding, switching pools when better ones appear. Sounds useful, right? But here’s the catch: there’s no proof it’s actually working.

The project’s smart contract is live on Ethereum, with the address 0x133B...FF3a13C. That’s a good sign - it means someone built it. But a deployed contract doesn’t mean users are using it. No transaction history. No liquidity pools with real funds. No recent updates on GitHub or Discord. It’s like a store with a sign out front but no customers inside.

The Token: SIL

SIL is the native token of the project. According to public data, the total supply is capped at 30,000 SIL tokens. But here’s where things get weird:

- CoinMarketCap and Bitget list the circulating supply as 0 SIL.

- The market cap is $0.00 on both platforms.

- Crypto.com says SIL is trading at $21.01 - but with zero 24-hour volume.

This isn’t just a data glitch. It’s a red flag. If no one is trading SIL, then the $21 price is meaningless. It could be a fake listing, a bot-generated price, or a placeholder. Real tokens need real buyers and sellers. Without that, the token has no utility - even if you get it for free.

Is There an Airdrop?

Yes, according to Bitget, there’s an airdrop. Their September 2025 update says users can "receive free SIL Finance airdrops by joining ongoing challenges and promotions." That’s the only concrete detail available.

But what kind of challenges? How many tokens will you get? Do you need to hold a minimum amount of another token? Is there a deadline? Is the airdrop still active? No one says.

Compare that to other DeFi airdrops - like Uniswap’s $UNI drop in 2020 or Curve’s $CRV airdrop. Those had clear rules: "Earn X amount of trading volume by Y date, get Z tokens." SIL Finance gives you nothing but a vague promise.

And here’s another problem: the project has no official website. No whitepaper. No Twitter with 10,000 followers. No Telegram group with active discussions. Just a contract address and a few crypto trackers showing $0 values. That’s not how successful projects operate.

Why the Confusion? Other Projects with Similar Names

Don’t get fooled by names that sound similar. There’s a completely different project called Silo Finance (SILO token), which did a real airdrop worth up to $15,000 in 2022. There’s also SilkAI, which offered 10 million SILK tokens. These are not SIL Finance.

Search engines mix them up. Blogs copy-paste old data. Reddit threads confuse the two. If you’re researching SIL, make sure you’re looking at the right token. The contract address 0x133B...FF3a13C is your only reliable identifier. Anything else is noise.

Should You Participate?

If you’re thinking about jumping into the SIL Finance airdrop, here’s what you need to ask yourself:

- Are you willing to spend time on a project with no track record?

- Do you trust a token that has zero trading volume and conflicting prices?

- Will you be able to sell or use these tokens later - or will they just sit in your wallet forever?

Most airdrops are designed to build a community. SIL Finance doesn’t have one. That means even if you get tokens, you’re not getting access to a network. You’re getting digital paper with no value behind it.

There’s a chance this project is still in early development. Maybe the team is working quietly. Maybe they’ll launch a real product next month. But right now, there’s no evidence of that.

And here’s the harsh truth: if you’re spending hours filling out forms, connecting wallets, and doing tasks for a token that might never trade, you’re wasting your time. That time could be spent on projects with real users, real volume, and real teams.

What to Do Instead

If you’re serious about DeFi airdrops, focus on projects with:

- Active development (GitHub commits in the last 30 days)

- Real trading volume (at least $100k daily)

- Clear documentation (whitepaper, roadmap, team profiles)

- Community engagement (Discord with hundreds of active members)

Look at projects like Aave, Compound, or even newer ones like Pendle or EigenLayer. They had airdrops because they had users. SIL Finance doesn’t.

That doesn’t mean you shouldn’t explore new projects. But treat every airdrop like a lottery ticket - not an investment. Only spend time on ones where the odds are better than 1 in 100.

For SIL Finance? The odds look worse than that.

Final Verdict

The SIL Finance airdrop exists on paper - but not in practice. There’s no proof the tokens have value. No proof the project is alive. And no proof you’ll be able to do anything with them after you get them.

If you still want to try, go to Bitget and check their promotions page. But don’t expect anything. Don’t invest time, money, or energy. Treat it like a free experiment - not a chance to get rich.

And if you do get SIL tokens? Don’t celebrate. Just store them safely and forget about them. Because unless the project wakes up soon, they’ll be worth less than the gas fee it took to claim them.

Is the SIL Finance airdrop real?

There’s no official confirmation from SIL Finance itself. The only mention comes from Bitget, which says users can earn tokens through challenges. But there are no details on how many tokens, how to qualify, or when it ends. The lack of a website, whitepaper, or active community makes it impossible to verify legitimacy.

Why do some sites say SIL is worth $21 and others say $0?

This is a sign of data inconsistency or manipulation. Platforms like Crypto.com may be showing a theoretical or outdated price based on zero trading volume. CoinMarketCap and Bitget show $0 because there’s no actual buying or selling happening. A token with no liquidity has no real value - regardless of what a chart says.

Can I sell SIL tokens after claiming them?

Not easily - if at all. There are no active DEXs or centralized exchanges listing SIL for trading. Even if you claim the tokens, you won’t find buyers. You’d need to wait for the project to launch proper listings, which hasn’t happened yet - and may never happen.

Is SIL Finance the same as Silo Finance or SilkAI?

No. Silo Finance (SILO) and SilkAI (SILK) are completely separate projects with different tokens, teams, and airdrops. Confusing them is common because of similar names, but they have nothing to do with SIL Finance. Always check the contract address: 0x133B...FF3a13C is the only valid one for SIL.

What should I do if I already claimed SIL tokens?

Don’t panic. Don’t share your private keys. Store the tokens in a non-custodial wallet like MetaMask. Don’t send them anywhere. Monitor the project for updates - but don’t expect anything. Treat them as a learning experience, not an asset. If the project never gains traction, the tokens will remain worthless.