Layer 2 Scaling Calculator

Your Potential Savings & Performance Gains

Layer 1: $0.00

Layer 2: $0.00

Potential Monthly Savings: $0.00

Transaction Speed: 0x faster

Throughput: 0 TPS

Latency Reduction: 0%

When you hear people complain about "sky‑high gas fees" or "slow confirmations" on Ethereum, they’re talking about the limits of the base chain. Layer 2 scaling solutions are secondary protocols that sit on top of a primary blockchain and process transactions off‑chain, then bundle them back onto the main ledger. The result? Near‑instant transaction speeds and fees that drop from dollars to fractions of a cent. Below we break down how this works, which solutions lead the pack in 2025, and how to pick the right one for your project.

Quick Insights

- Layer 2 can push throughput from 20‑30TPS on Ethereum to several thousand TPS.

- Typical fees on popular Layer2s are under $0.01, compared with $5‑$30 on Layer1 during peak periods.

- Most leading solutions (Polygon, Arbitrum, Optimistic Rollup, zk‑Rollup) are EVM‑compatible, easing migration.

- Security still relies on the underlying Layer1; you trade speed for a slightly different risk profile.

- Selecting a Layer2 hinges on speed, fee budget, decentralization, and use‑case (DeFi, NFTs, gaming, etc.).

What is Layer 2 Scaling?

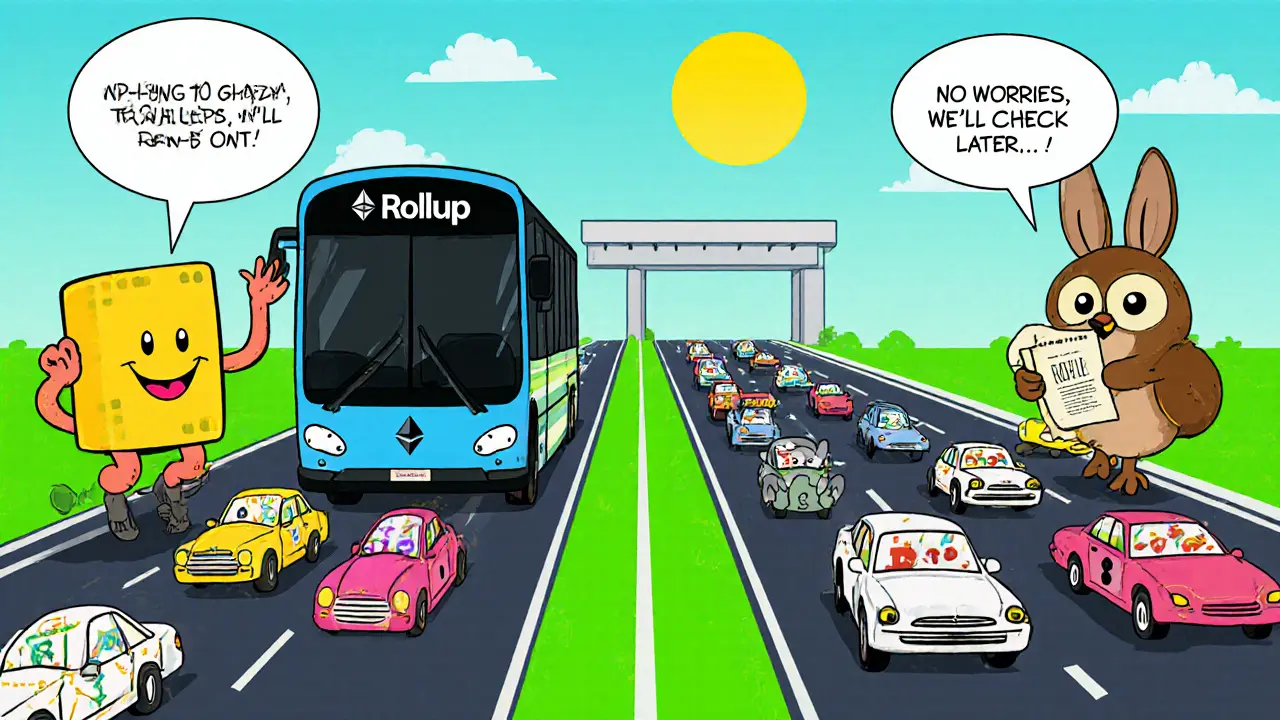

At its core, a Layer2 protocol aggregates hundreds or thousands of individual transactions into a single "rollup" that gets posted to the main chain. Think of it as a carpool lane on a highway - many cars (transactions) travel together, paying a single toll (gas) instead of each paying individually. The main chain (Layer1) still validates the final batch, preserving security while freeing up space for new activity.

Two main technical families dominate the space:

- Optimistic Rollups - assume transactions are valid and only run a fraud proof if someone challenges them.

- zk‑Rollups - generate a cryptographic proof that all bundled transactions are correct before they hit the main chain.

How Layer 2 Boosts Transaction Speed

Traditional Layer1 chains like Bitcoin manage about 7TPS, and Ethereum hovers around 25TPS during normal conditions. By moving the heavy lifting off‑chain, Layer2s can achieve:

- Block times as low as 2seconds - Polygon processes blocks every 2.1seconds, versus roughly 12‑seconds for Ethereum.

- Batching of up to 2,000 transactions per rollup, slashing per‑tx latency to milliseconds.

- Parallel execution via sharding or multi‑chain designs, allowing multiple rollups to settle simultaneously.

The net effect feels like a typical web app: clicks confirm instantly, and users never stare at a "pending" screen.

Cost Savings on Layer 2 vs Layer 1

On Ethereum’s mainnet, a simple ERC‑20 transfer can cost $10‑$30 during congestion. On a Layer2:

- Polygon charges <0.001ETH (≈$0.0003) per tx - essentially a few cents for a batch of 1,000 swaps.

- Arbitrum’s average fee hovers around $0.002, thanks to bundled calldata.

- zk‑Rollups like ImmutableX can push fees below $0.001 for NFT minting.

These savings unlock use‑cases that were previously uneconomical, such as high‑frequency DeFi trading, micro‑payments in gaming, and mass NFT drops.

Leading Layer 2 Solutions in 2025

Below is a snapshot of the most widely adopted solutions as of October2025. All listed projects maintain a direct security link to Ethereum, but they differ in architecture, throughput, and fee models.

| Solution | Rollup Type | Typical TPS | Avg. Fee (USD) | EVM Compatibility |

|---|---|---|---|---|

| Polygon | Optimistic | 4,000 | 0.0003 | Full |

| Arbitrum | Optimistic | 3,200 | 0.002 | Full |

| Optimism | Optimistic | 2,800 | 0.001 | Full |

| ImmutableX | zk‑Rollup | 9,000 | 0.0008 | Partial (NFT focus) |

| Loopring | zk‑Rollup | 2,500 | 0.0005 | Full |

Note that "Typical TPS" reflects real‑world usage, not theoretical maximums. Fees are averages taken from a mix of token swaps, NFT mints, and simple transfers.

Choosing the Right Layer 2 for Your Use Case

Not every solution fits every project. Use the checklist below to match requirements with the right rollup type:

- Speed vs. Security Trade‑off: zk‑Rollups provide cryptographic certainty but can be slightly slower to generate proofs. Optimistic Rollups are faster to publish but rely on a fraud‑proof window (typically 1‑7 days).

- Fee Sensitivity: For micro‑transactions (gaming rewards, per‑second payments), prioritize the lowest‑fee networks like Polygon or Loopring.

- EVM Compatibility: If you already have Solidity contracts, stay on an EVM‑compatible rollup to avoid rewrites.

- Decentralization Needs: Arbitrum and Optimism have larger validator sets, which may matter for high‑value DeFi protocols.

- Specific Asset Support: ImmutableX shines for NFT marketplaces, while Polygon’s broad ecosystem supports a wide range of dApps.

Map your priorities, then test on a testnet before committing mainnet assets.

Implementation Tips & Common Pitfalls

Getting started is easier than it used to be, but a few practical tips can save weeks of debugging:

- Bridge Early, Bridge Often: Moving assets across chains incurs a one‑time cost; batch movements to minimize fees.

- Watch the Fraud‑Proof Window: On Optimistic Rollups, withdrawals can be delayed up to a week while fraud proofs are available.

- Stay Updated on Contract Versions: Polygon recently upgraded to a V3 bridge, which changes address formats.

- Monitor Gas Token Prices: Even on Layer2, transaction costs fluctuate with demand; set dynamic fee caps in your smart contracts.

- Backup Private Keys on Both Layers: Losing access to your L1 wallet also cuts off L2 funds.

Adopt a CI/CD pipeline that runs integration tests on the chosen Layer2 testnet. This catches incompatibilities before they hit production.

Future Outlook - What Comes After Layer 2?

Layer2 isn’t a stop‑gap; it’s becoming core infrastructure. By 2026, we expect:

- Hybrid rollups that blend optimistic and zk proofs for speed + certainty.

- Deeper cross‑chain bridges allowing assets to hop from Ethereum L2 to other L1s (Solana, Avalanche) without central custodians.

- Enterprise‑grade L2s with SLA guarantees, making blockchain a viable substitute for traditional databases.

- Native support for multi‑asset batch settlements, dramatically cutting costs for DeFi aggregators.

In short, today’s Layer2 solutions are paving the way for a truly scalable Web3 where users never notice the blockchain under the hood.

Frequently Asked Questions

Why are Layer 2 fees so much lower than Layer 1?

Layer 2 bundles many transactions into a single calldata payload that the main chain processes once. The gas cost is shared across all bundled txs, turning a $10‑$30 fee into a few cents for the whole batch.

Is my money safe on a Layer 2 rollup?

Security ultimately inherits from the underlying Layer1 (Ethereum). If the rollup operator misbehaves, anyone can submit a fraud proof that reverts the malicious batch, protecting user funds.

How long does it take to withdraw from an Optimistic Rollup?

Because of the 7‑day fraud‑proof window, standard withdrawals can take up to a week. Some rollups now offer fast exits via liquidity providers, cutting the time to minutes for a small fee.

Can I use existing Solidity contracts on Polygon?

Yes. Polygon is fully EVM‑compatible, so you can deploy the same bytecode without changes. Just point your wallet to Polygon’s RPC endpoint.

What’s the difference between zk‑Rollup and Optimistic Rollup?

zk‑Rollup generates a cryptographic proof that all bundled transactions are valid before posting to L1, giving instant finality. Optimistic Rollup assumes validity and only runs a proof if someone challenges the batch, which can delay finality but reduces on‑chain computation.