VASP Costa Rica: What You Need to Know About Crypto Licensing in Costa Rica

When we talk about VASP, a Virtual Asset Service Provider is any business that handles crypto transfers, exchanges, or custody services. Also known as crypto service providers, it’s the legal label governments use to bring crypto firms under financial oversight. In Costa Rica, VASP rules are still developing — but they’re already shaping who can operate legally and who gets shut down.

Unlike countries like the U.S. or EU, Costa Rica doesn’t have a full crypto law yet. But that doesn’t mean there’s no regulation. The country’s Financial Intelligence Unit (UIF) started pushing VASP registration in 2023, requiring any business that moves crypto for others to apply for a license. This includes exchanges, wallet providers, and even some DeFi platforms if they act as intermediaries. If you’re running a crypto business here without registering, you’re operating in a legal gray zone — and that’s risky. Banks in Costa Rica have already frozen accounts tied to unlicensed crypto operations, and the UIF has begun sharing data with international regulators under FATF guidelines. This means your business could be flagged globally, not just locally.

What’s more, VASP registration isn’t just about paperwork. It requires clear KYC/AML procedures, audit trails, and a physical presence in Costa Rica. Many small crypto startups assumed they could operate remotely — but that’s no longer enough. The same rules apply to foreign exchanges targeting Costa Rican users. If you’re a trader or investor here, you should only use platforms that show a valid VASP registration number. Otherwise, you’re trusting a company that could vanish overnight with no legal recourse. The lack of public registry makes this tricky, but the UIF has started publishing names of registered entities — if you can’t find a platform on that list, assume it’s not compliant.

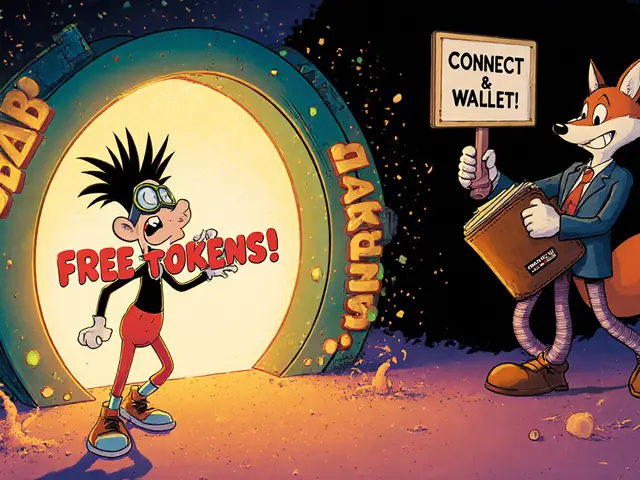

Costa Rica’s crypto scene is growing fast — especially in tech hubs like San José and Liberia — but the infrastructure hasn’t kept up. There’s no official crypto exchange licensed yet, and most local platforms still rely on offshore licenses. That’s why you’ll see so many posts here about failed exchanges, suspicious airdrops, and unverified DeFi projects. They’re not just bad luck — they’re symptoms of a market trying to grow without clear rules. The VASP framework is meant to fix that. It’s not about shutting down innovation. It’s about making sure the people who build and use crypto here aren’t left with nothing when things go wrong.

Below, you’ll find real case studies of crypto platforms that ran into trouble in Costa Rica — and others that made it through the system. Some posts show how businesses got shut down for skipping VASP registration. Others explain how to spot a fake license or avoid a scam that looks like a compliant exchange. Whether you’re a trader, developer, or just trying to keep your crypto safe, this collection gives you the facts you need to move forward without getting burned.

Categories