USDC Trading: What You Need to Know About Stablecoin Trading and Risks

When you trade USDC, USD Coin is a digital dollar pegged 1:1 to the U.S. dollar, issued by Circle and Coinbase. Also known as USD Coin, it’s one of the most trusted stablecoins used for trading, lending, and moving value across crypto markets without the wild swings of Bitcoin or Ethereum. Unlike volatile coins, USDC keeps its value steady — which is why traders use it to park funds during market crashes, enter new positions quickly, or avoid cashing out to fiat.

But USDC trading isn’t just about safety. It’s tied to real-world finance, regulation, and trust. The company behind it, Circle, holds reserves in U.S. Treasuries and cash, and those reserves are audited monthly. That’s why exchanges like Binance, Kraken, and Coinbase list it heavily. But if those reserves ever get questioned — like during the 2023 banking crisis when USDC briefly dropped to $0.87 — panic spreads fast. So while USDC is stable most of the time, it’s not immune to systemic risk. You’re not just betting on crypto prices; you’re betting on the financial system backing it.

People use USDC for more than just holding. It’s the go-to pair for trading altcoins on decentralized exchanges like Uniswap or PancakeSwap. Traders swap ETH for USDC to lock in profits, then buy new tokens when they see opportunity. It’s also used in DeFi protocols for lending, borrowing, and earning yield — think Aave or Compound. But here’s the catch: if the platform you’re using gets hacked, or if Circle freezes your USDC due to compliance issues (yes, they can), you lose access. That’s not theoretical. It’s happened to users in sanctioned countries.

USDC trading also connects to legal gray areas. Posts on LedgerBeat show how places like Costa Rica and Namibia let crypto fly under the radar — and USDC is often the currency of choice there because it’s easy to move and harder to trace than cash. But that same flexibility makes it attractive to bad actors, which is why regulators are watching. The upcoming CRS 2.0 tax rules in 2026 will track your USDC trades globally, whether you like it or not.

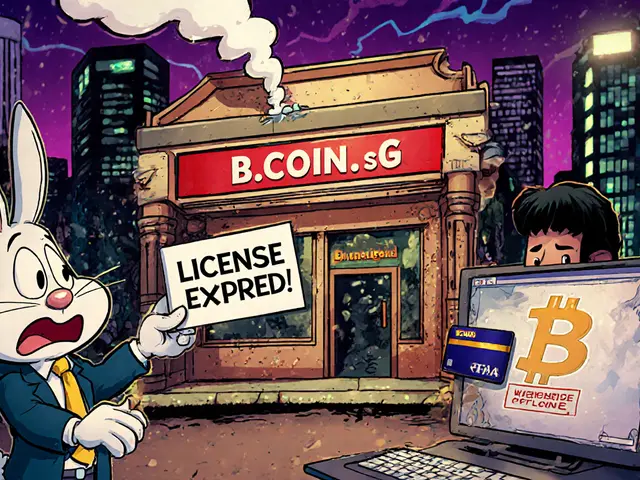

And while USDC is stable, the tools you use to trade it aren’t. Some exchanges, like the now-shutdown BCoin.sg or XeggeX, promised low fees and fast trades but vanished without warning. Others, like Biteeu, are licensed in the EU but lack transparency. If you’re trading USDC, you’re not just choosing a coin — you’re choosing a platform, a jurisdiction, and a level of risk.

So what does this mean for you? USDC trading gives you control, speed, and stability — but only if you understand the layers behind it. It’s not magic money. It’s backed by banks, regulated by governments, and vulnerable to the same failures as traditional finance. The posts below break down real cases: how USDC is used in airdrops, why some exchanges fail, how compliance can freeze your funds, and what happens when the system cracks. You’ll see what works, what doesn’t, and how to protect yourself before you trade another dollar’s worth.

Categories