Secure Crypto Trading: How to Trade Safely and Avoid Scams

When you trade secure crypto trading, the practice of buying, selling, and holding digital assets while minimizing risk of theft, fraud, or regulatory fallout. Also known as safe crypto practices, it’s not just about using strong passwords—it’s about choosing platforms that actually follow rules, not just promise high returns. Most people lose money not because the market dropped, but because they used a platform that vanished overnight or got tricked into sending crypto to a fake airdrop.

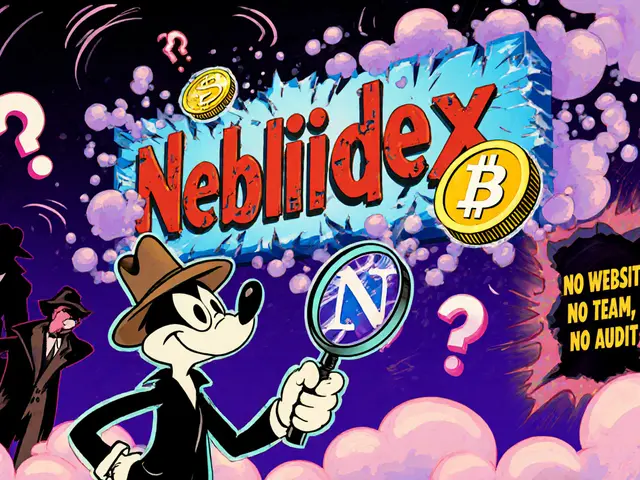

There are three big traps in crypto exchange security, the systems and policies that protect users’ funds and data on trading platforms: unlicensed operators, fake airdrops, and platforms with no audits or team. Look at what happened to BCoin.sg, a Singapore-based crypto exchange that shut down due to lack of regulation and poor user experience, or Neblidex, a platform with no team, no audits, and no support that still tried to pass as a real exchange. These weren’t hacks—they were warnings. If a platform doesn’t show who runs it, doesn’t publish security reports, and doesn’t have a license, it’s not secure. It’s a waiting room for failure.

Crypto scams, fraudulent schemes designed to steal crypto through fake promises, impersonation, or manipulated incentives are everywhere. The PVU BSC MVB III Event, a fake airdrop that tricked users into sending tokens to claim rewards is a perfect example. Real airdrops don’t ask you to send crypto first. They give you tokens for free, often for simple tasks like following a Twitter account. If it sounds too easy, or if they ask for your private key, it’s a scam. And it’s not just new users who get fooled—people in Namibia and Costa Rica face banking blocks and legal gray zones because they trusted platforms that didn’t play by the rules. That’s why crypto licensing, the legal requirement for crypto businesses to register and comply with financial regulations matters. A licensed exchange has to prove it’s serious. An unlicensed one? It’s just a website with a logo.

You don’t need to be a tech expert to trade safely. You just need to ask the right questions: Who runs this? Are they registered? Do they have public audits? Have they been hacked before? The answers are out there—in reviews, in regulatory filings, in community forums. The posts below cover real cases: exchanges that died, airdrops that were fake, tokens with zero backing, and countries where crypto is legal but banks still freeze accounts. You’ll see what to avoid, what to look for, and how to spot the difference between a real opportunity and a trap. This isn’t theory. These are the stories of people who lost money—and how you can stay out of their shoes.

Categories