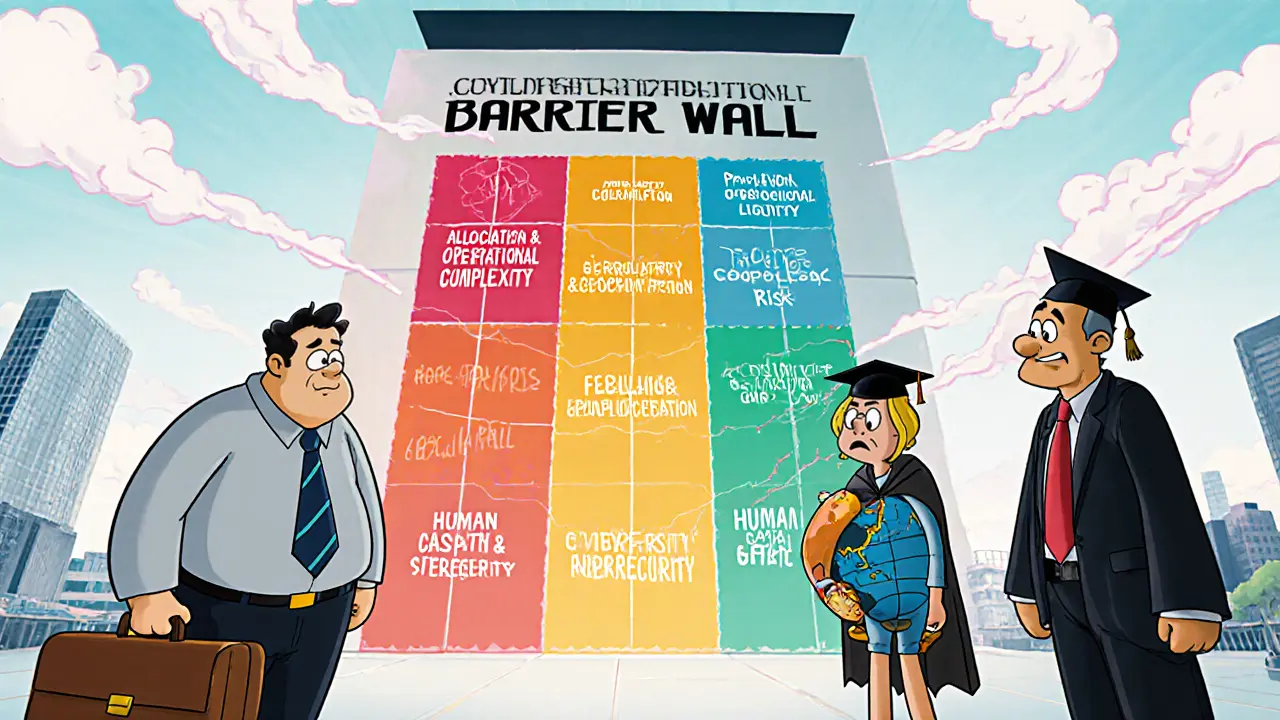

Institutional Investment Barriers: Why Big Money Stays Out of Crypto

When you explore institutional investment barriers, the set of legal, operational, and market obstacles that stop large financial players from diving into digital assets, the picture becomes clear. These hurdles include KYC compliance, the process of verifying client identities to satisfy anti‑money‑laundering rules and the broader cryptocurrency regulation, government policies that dictate how digital assets can be offered, traded, and taxed. Add to that the need for proper exchange licensing, official approvals that let platforms serve institutional clients legally, and you’ve got a complex maze that many firms hesitate to enter.

These three entities are tightly linked. institutional investment barriers encompass KYC compliance, which requires robust identity‑verification tools and clear data‑privacy policies. At the same time, cryptocurrency regulation influences exchange licensing by setting the standards that exchanges must meet to operate legally for institutions. In practice, a firm that wants to launch a crypto fund must first clear KYC checks, then demonstrate compliance with local regulation, and finally obtain a license that matches the regulatory framework. Missing any piece can shut down the whole plan.

How These Barriers Shape Real‑World Decisions

Because of the tangled web of rules, many institutional players stick to traditional assets or only dip their toes into crypto through regulated vehicles like futures or trusts. The fear of hefty fines—think the $34 billion potential penalties faced by Upbit for KYC failures—pushes risk‑averse firms toward markets with clearer guidance. Meanwhile, emerging regions such as Nigeria are rolling out new crypto licensing regimes, but the requirement for capital reserves and AML controls still feels like a steep hill for newcomers. This mix of fear, cost, and uncertainty explains why the crypto market still sees a dominance of retail traders despite the growing interest from big funds.

Below you’ll find a curated set of articles that break down each of these hurdles, from deep dives into KYC procedures and regulatory updates to practical guides on exchange licensing and how institutional investors are finally starting to move past the barriers.

Categories