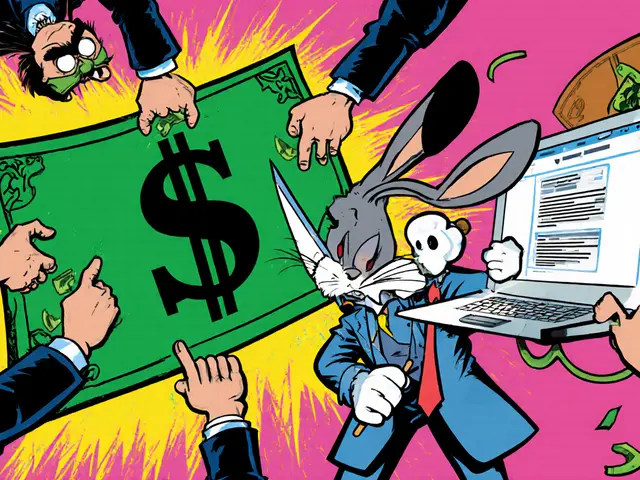

Cryptocurrency Taxation – What You Need to Know

When dealing with cryptocurrency taxation, the process of calculating, reporting, and paying taxes on crypto transactions. Also known as crypto tax, it covers capital gains, income, and staking rewards that fall under tax law. Cryptocurrency taxation isn’t just a paperwork chore; it dictates how you keep records, when you file, and what penalties you might face if you slip up. In short, cryptocurrency taxation encompasses record‑keeping (Subject) requires (Predicate) accurate transaction logs (Object), and it influences (Predicate) your overall tax liability (Object). Understanding this web helps you avoid surprise audits and stay compliant.

Key Elements Shaping Your Tax Burden

One major piece of the puzzle is crypto tax filing, the act of submitting your crypto‑related earnings to tax authorities. It often involves forms like Schedule D or 8949 in the U.S., or similar schedules elsewhere. Another crucial factor is tax residency, the country where you are considered a tax resident. Your residency determines which tax rates apply, whether you get exemptions, and which reporting thresholds kick in. For example, a trader living in India faces different capital‑gain rules than someone in Germany. Combining crypto tax filing with the right tax residency information creates a clear picture of what you owe, when you owe it, and how you can legally reduce your bill.

The final layer is tax compliance, meeting all legal obligations related to crypto taxes. This includes staying up‑to‑date with crypto regulations, government rules that govern how crypto activities are taxed and reported. Compliance requires (Predicate) using reliable accounting tools (Object) and sometimes hiring a professional. As regulators tighten rules—think of the recent FATF guidance or the IRS’s expanded Form 1040‑SA—the link between tax compliance and crypto regulations becomes tighter. Ignoring these changes can trigger audits, penalties, or even criminal charges. By treating compliance as an ongoing habit rather than a yearly scramble, you keep your crypto finances healthy and your peace of mind intact.

Below, you’ll find a curated selection of articles that break down each of these topics—how to track trades, file correctly in different jurisdictions, navigate the latest regulatory updates, and use the best tools for the job. Dive in to turn the complexity of cryptocurrency taxation into a manageable, actionable plan.

Categories