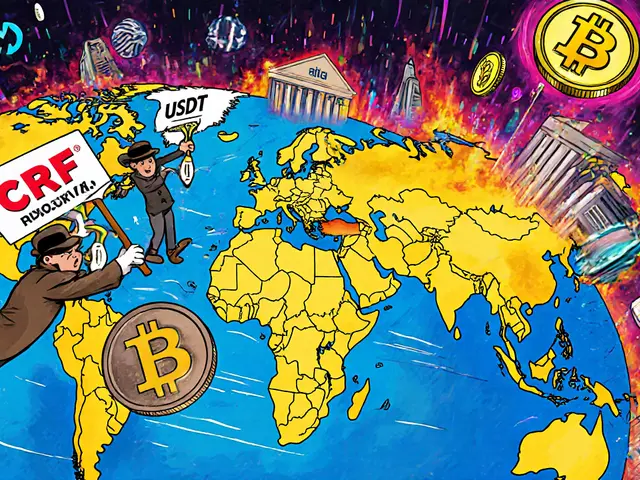

Crypto Enforcement China – What’s Changing and Why It Matters

When working with Crypto Enforcement Chinathe set of actions Chinese authorities take to control crypto activity, ranging from bans to heavy finesChina Crypto Crackdown, you’re stepping into a fast‑moving policy arena. This enforcement encompasses Crypto Regulationsrules that define what digital assets can be traded, mined or advertised in China, which in turn requires stricter KYC compliancethe process of verifying user identities before allowing transactions from exchanges operating in or serving Chinese users. The ripple effect reaches crypto exchangesplatforms that match buyers and sellers of digital assets worldwide, pushing them to upgrade security, reporting and licensing to stay out of the regulator’s crosshairs.

Key Areas of Enforcement

First up, the government’s push on Crypto Enforcement China has turned the spotlight on how exchanges collect and store user data. New KYCrequirements now demand real‑name verification, biometric checks and cross‑border data sharing for any account linked to Chinese IP addresses. Failure to comply can trigger fines that run into the billions, as seen in the recent Upbit penalty saga. Meanwhile, Crypto Regulationshave broadened to ban all crypto‑related fundraising, including Initial Coin Offerings and token airdrops, citing financial stability and fraud prevention. This forces projects to redesign token distribution models or risk being blacklisted from the mainland market.

Second, tax rules are tightening. The tax office now treats crypto swaps as taxable events, meaning every trade can generate a capital gains liability. Exchanges that ignore these obligations face both financial and operational penalties, which in turn pressures them to embed automated tax reporting tools. The enforcement drive also weeds out unlicensed platforms, meaning users see a shrinkage in the number of “quick‑cash” venues that previously operated under the radar.

Finally, the broader impact on the ecosystem can’t be ignored. When China tightens its grip, global liquidity dries up, price volatility spikes, and compliance costs rise for every market participant. This cascade forces DeFi protocols to reconsider cross‑chain bridges that touch Chinese wallets, and investors to scrutinize the jurisdictional risk of each token they hold. In short, the enforcement wave reshapes everything from on‑ramp choices to long‑term investment strategies.

Below you’ll find a curated selection of articles that break down each of these moving parts—whether you need a step‑by‑step guide on KYC updates, an analysis of the latest regulatory announcements, or practical tips for staying compliant while trading. Dive in to see how the enforcement trend is playing out across exchanges, tax reporting and token projects, and arm yourself with the knowledge you need to navigate China’s crypto landscape safely.

Categories