Automated Market Makers (AMM) – Everything You Need to Know

When dealing with Automated Market Maker, a smart‑contract system that automatically prices assets and executes trades. Also known as AMM, it powers Decentralized Exchange, a platform where users trade directly from wallets, relies on Liquidity Pool, a reserve of tokens used to facilitate swaps, and enables Token Swap, instant exchange of one crypto for another. This ecosystem removes the need for traditional order books and lets anyone trade 24/7.

Automated Market Maker protocols use mathematical formulas—most commonly the constant product model x·y=k—to keep prices balanced as users trade. When you swap a token, the contract pulls from the pool, adjusts the ratio, and automatically reflects the new market price. Because the code handles pricing, trades happen in a single transaction, which is faster and cheaper than matching buyers and sellers on a centralized platform. This simplicity also means developers can launch new markets by just deploying a pool, opening the door to hundreds of niche assets.

Liquidity providers (LPs) are the backbone of any AMM. By depositing equal values of two tokens into a pool, they receive LP tokens that represent their share. In return, they earn a portion of every swap fee, typically 0.2‑0.3 % of the trade volume. However, LPs also face impermanent loss—the temporary dip in value when one side of the pair moves dramatically. Understanding how fee structures offset that risk is crucial before committing capital.

Most major decentralized exchanges rely on AMMs. Uniswap, SushiSwap, Curve and Balancer each tweak the core formula to serve different use‑cases: stablecoin swaps with low slippage, multi‑asset pools, or weighted token ratios. These platforms illustrate how a single concept—automated pricing—can spawn a whole ecosystem of specialized markets. When a DEX launches a new pool, traders instantly gain access without waiting for a listing approval.

Recent trends push AMMs beyond single‑chain limits. Cross‑chain bridges let users provide liquidity on one blockchain while swapping assets on another, expanding capital efficiency. Layer‑2 solutions like Optimism and Base lower gas costs, making small trades viable. Meanwhile, dynamic fee models adjust rates based on volatility, aiming to protect LPs during market swings. Keeping an eye on these upgrades helps traders stay ahead of fee‑saving opportunities.

What You’ll Find Below

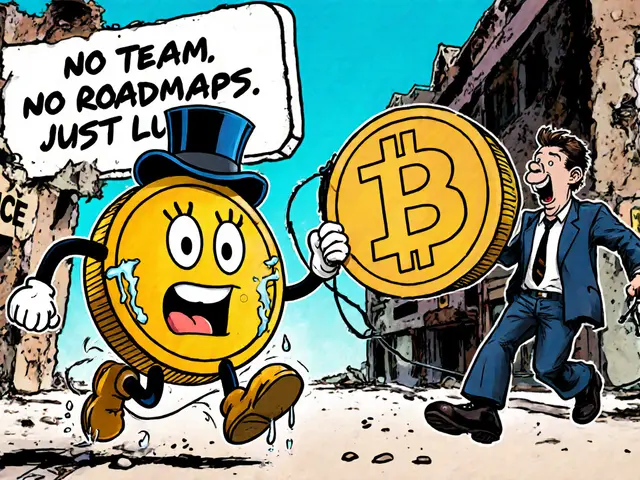

Below is a curated list of articles that dive deeper into AMM‑related projects and concepts. You’ll see a Wrapped Harmony (WONE) walkthrough, a detailed Uniswap v2 review on Base, a Switcheo Network DEX deep‑dive, and a guide on spotting rug pulls in smart contracts. Each piece offers step‑by‑step instructions, risk analysis, and real‑world examples, giving you the tools to navigate the AMM landscape confidently.

Whether you’re a curious newcomer or a seasoned liquidity provider, the collection equips you with practical insights and actionable tips to make smarter decisions in the fast‑moving world of automated market makers.

Categories