MachineX Crypto Exchange Risk Checker

Rate each criterion on a scale of 1-5 (1 = Poor, 5 = Excellent) to assess MachineX's reliability:

Enter ratings above and click "Evaluate MachineX Risk Level" to see results

When you type ‘MachineX crypto exchange review’ into a search bar, the answer you get is usually a thin slice of information, not the deep dive you need before you trust any platform with your money. That uncertainty is the reality for many traders in 2025, and it’s why a solid review must go beyond headline features and dig into the fundamentals that separate a reputable exchange from a risky newcomer.

TL;DR - Quick Takeaways

- MachineX lacks publicly available documentation on fees, security protocols, and regulatory status.

- It does not appear on major scam‑tracker lists, but the silence on official sites is itself a red flag.

- Before depositing, verify KYC requirements, insurance coverage, and customer‑support responsiveness.

- Compare MachineX against established platforms - Binance, Coinbase, Kraken - using the checklist below.

- If any critical piece of information is missing, consider a more transparent exchange.

What Is MachineX?

MachineX is a cryptocurrency exchange that claims to offer spot and derivatives trading with a modern UI. The platform’s official website mentions a MachineX Exchange, but provides no clear founding date, headquarters, or regulatory licenses.

Because a trustworthy cryptocurrency exchange serves as a digital marketplace where users can buy, sell, and trade crypto assets usually publishes whitepapers, audit reports, and compliance certificates, the scarcity of such material for MachineX is the first point of concern.

Key Red Flags and Information Gaps

Here are the most common areas where MachineX falls short of industry standards:

- Founding details: No verifiable record of when the company was incorporated or where its legal entity resides.

- Regulatory compliance: No mention of licensing from bodies such as the Financial Conduct Authority (UK) or the Securities and Exchange Commission (US). In many jurisdictions, a lack of registration limits consumer protection.

- Security measures: The site does not disclose whether it employs cold‑storage, multi‑signature wallets, or regular third‑party security audits.

- Fee structure: No transparent table showing maker/taker fees, withdrawal costs, or hidden spreads.

- KYC / AML policies: It is unclear if MachineX requires identity verification for higher limits, a standard practice to meet anti‑money‑laundering regulations.

- Customer support: Support channels appear limited to an email form; there’s no live chat, phone line, or documented response‑time SLA.

How to Evaluate Any Crypto Exchange (A Practical Framework)

Even if a platform like MachineX eventually fills in its blanks, you should run it through a robust checklist before you trade:

- Legal registration: Verify the company’s incorporation country and any licenses from financial authorities.

- Security posture: Look for cold‑wallet percentages, bug‑bounty programs, and audit reports from reputable firms.

- Fee transparency: Clear maker/taker rates, withdrawal fees, and any hidden costs.

- KYC/AML compliance: Ensure the exchange follows Know‑Your‑Customer and Anti‑Money‑Laundering guidelines appropriate for your jurisdiction.

- Liquidity: Check average daily trading volume; high liquidity reduces slippage.

- Insurance: Some exchanges offer crypto‑insurance for custodial assets; note the coverage limits.

- Customer support: Availability of 24/7 chat, ticketing system, and documented response times.

- User reviews & community sentiment: Scan forums, Reddit, and Trustpilot for consistent feedback patterns.

What We Do Know About MachineX - Pros & Cons

Based on the limited data available, here’s a balanced snapshot:

| Aspect | Available Info | Typical Expectation |

|---|---|---|

| Founding date & HQ | Not disclosed | Clear legal entity and location |

| Regulatory licensing | Unclear | Registered with a recognized regulator |

| Security features | No public audit | Cold storage, 2FA, regular audits |

| Fee structure | Not published | Transparent maker/taker rates |

| KYC requirements | Unknown | Tiered verification for limits |

| Customer support | Email only | Live chat + ticket SLA |

While the lack of specifics is unsettling, the exchange does not appear on any official scam‑tracker list maintained by the Massachusetts Attorney General, which means there are no confirmed fraud reports at the time of writing.

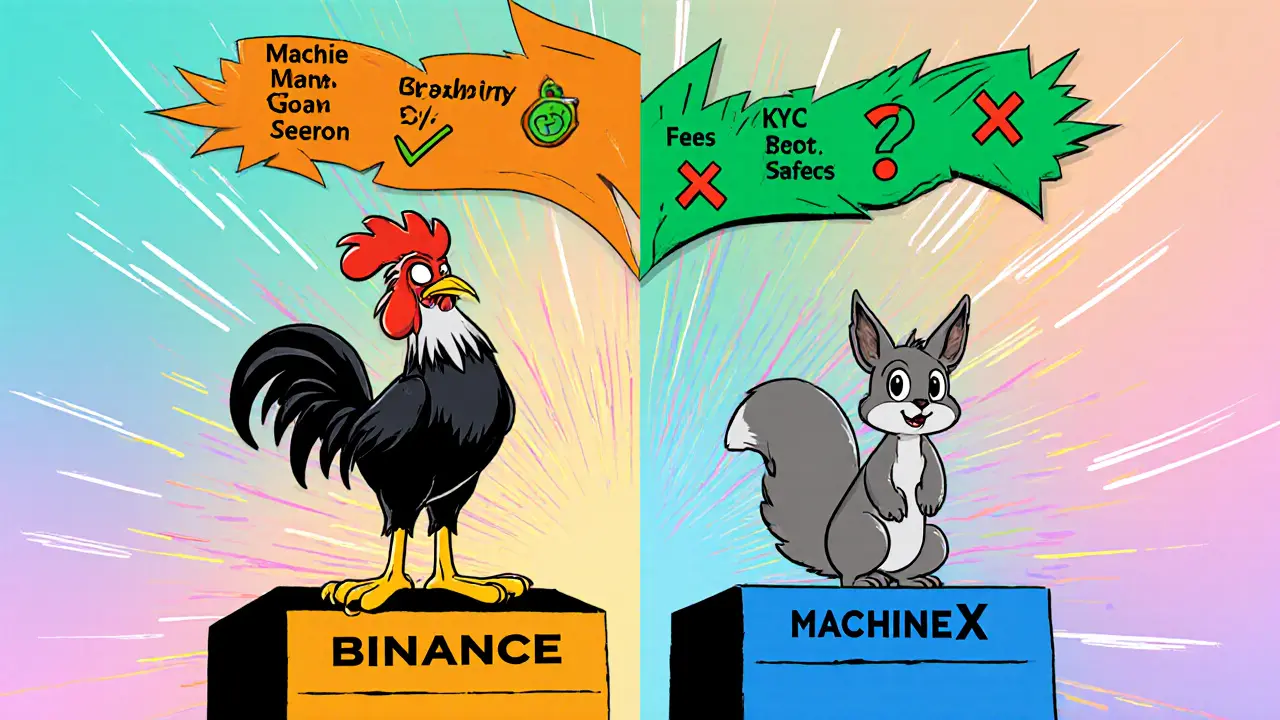

Side‑by‑Side Comparison with Established Exchanges

| Criterion | MachineX | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Regulatory license | Unknown | Multiple licences (Malta, USA) | NYDFS, FCA, etc. | FINMA, FCA |

| Security audits | None disclosed | Annual SOC 2, Hacken audit | CC‑EAL5+ audit | Quarterly audit reports |

| Fee structure | Undisclosed | 0.1% taker, 0% maker (VIP tiers) | 0.5% flat fee | 0.26% taker, 0% maker |

| KYC level | Unclear | Mandatory for fiat | Full ID verification | Full ID verification |

| Customer support | Email only | 24/7 live chat | Phone, chat, email | Live chat, ticket system |

| Insurance | Not mentioned | Cold‑wallet insurance up to $200M | SR‑20 insurance for custodial assets | Insurance for hot wallets |

From the table it’s clear that MachineX lags behind in public transparency. If you value security certifications, clear fee schedules, and robust support, the established exchanges set a higher baseline.

Practical Checklist Before You Deposit on MachineX

- Locate the Terms of Service and verify the legal entity name.

- Search for an independent security audit (e.g., from CertiK or PeckShield). If none, request one from the exchange.

- Test the withdrawal process with a small amount; note any unexpected fees.

- Check whether the platform offers two‑factor authentication (2FA) or hardware‑wallet integration.

- Contact support with a simple question; gauge response time and helpfulness.

- Cross‑reference user reviews on Reddit’s r/CryptoCurrency, Trustpilot, and local forums.

- Confirm that the exchange complies with the KYC/AML rules of your jurisdiction.

- If any step fails or feels vague, consider moving funds to a more transparent service.

Bottom Line

The MachineX crypto exchange review reveals a platform that is still in a gray area of the crypto ecosystem. Its silence on essential topics - licensing, security audits, fees, and support - should make any trader pause. In 2025, the safest bet is to pick an exchange that openly publishes its compliance documents, security practices, and fee schedules. Use the checklist above to vet MachineX, and don’t hesitate to switch to a well‑documented alternative if the answers remain elusive.

Frequently Asked Questions

Is MachineX a scam?

There are no confirmed fraud reports against MachineX as of October 2025, but the lack of public information on licensing, security audits, and fees is a strong warning sign. Treat it as a high‑risk platform until more transparency is provided.

What fees does MachineX charge?

MachineX does not publish a fee schedule on its website. Users must rely on trial withdrawals or direct contact with support to learn about maker/taker fees, spread costs, or withdrawal charges.

Does MachineX support two‑factor authentication?

The platform mentions basic login security, but it does not explicitly list 2FA or hardware‑wallet integration. Verify this feature before enabling large balances.

How does MachineX compare to Binance in terms of security?

Binance publishes regular third‑party audits, cold‑wallet insurance, and a bug‑bounty program. MachineX offers no public proof of similar safeguards, making Binance the safer choice for most users.

Can I trade without KYC on MachineX?

The site does not clarify KYC thresholds. Some exchanges allow low‑volume trading without verification, but this can change abruptly. Contact support to confirm current limits.